- Digital Products & Software

Empowering Merchants With Seamless POS Onboarding & Digital Solutions

Empowering Merchants With Seamless POS Onboarding & Digital Solutions

Client Overview

Founded in 1998, Pine Labs has established itself as a leading Indian fintech company, delivering integrated payment solutions and POS systems across India, Asia, and the Middle East. Renowned for its EMV-compliant POS terminals, cloud-based payment platforms, and merchant financing options, Pine Labs facilitates seamless digital transactions through credit/debit cards, UPI, and mobile wallets. By empowering retailers, small businesses, and sectors such as e-commerce and banking, Pine Labs drives digital transformation and fosters financial inclusion in emerging markets.

The Challenge

As India transitions into a digital economy, businesses require reliable POS systems and soundboxes to streamline transactions, enhance customer experiences, and comply with digital payment regulations. POS systems enable cashless payments via cards, UPI, or mobile wallets, while soundboxes provide transaction confirmations in local languages—crucial for rural areas. These tools help reduce cash dependency, ensure transparent record-keeping, comply with GST, and promote financial inclusion.

However, small merchants, especially in Tier 2 and Tier 3 cities, face significant hurdles in acquiring and using POS terminals and soundboxes:

- Complex Documentation: Merchants must navigate cumbersome processes, raising tickets on payment provider websites and submitting extensive documents such as GST registrations, shop certificates, and ID proofs. This manual approach often leads to delays of 4-5 days.

- Technical Barriers: Limited technical and digital literacy hampers merchants’ ability to handle tasks like KYC, bank detail submissions, and document provisioning.

- Regulatory Hurdles: The multi-layered approval process involving NSDL, merchant banks, PSPs, fintech companies, and the RBI ensures compliance but adds complexity and delays, deterring small and rural businesses.

Solutions

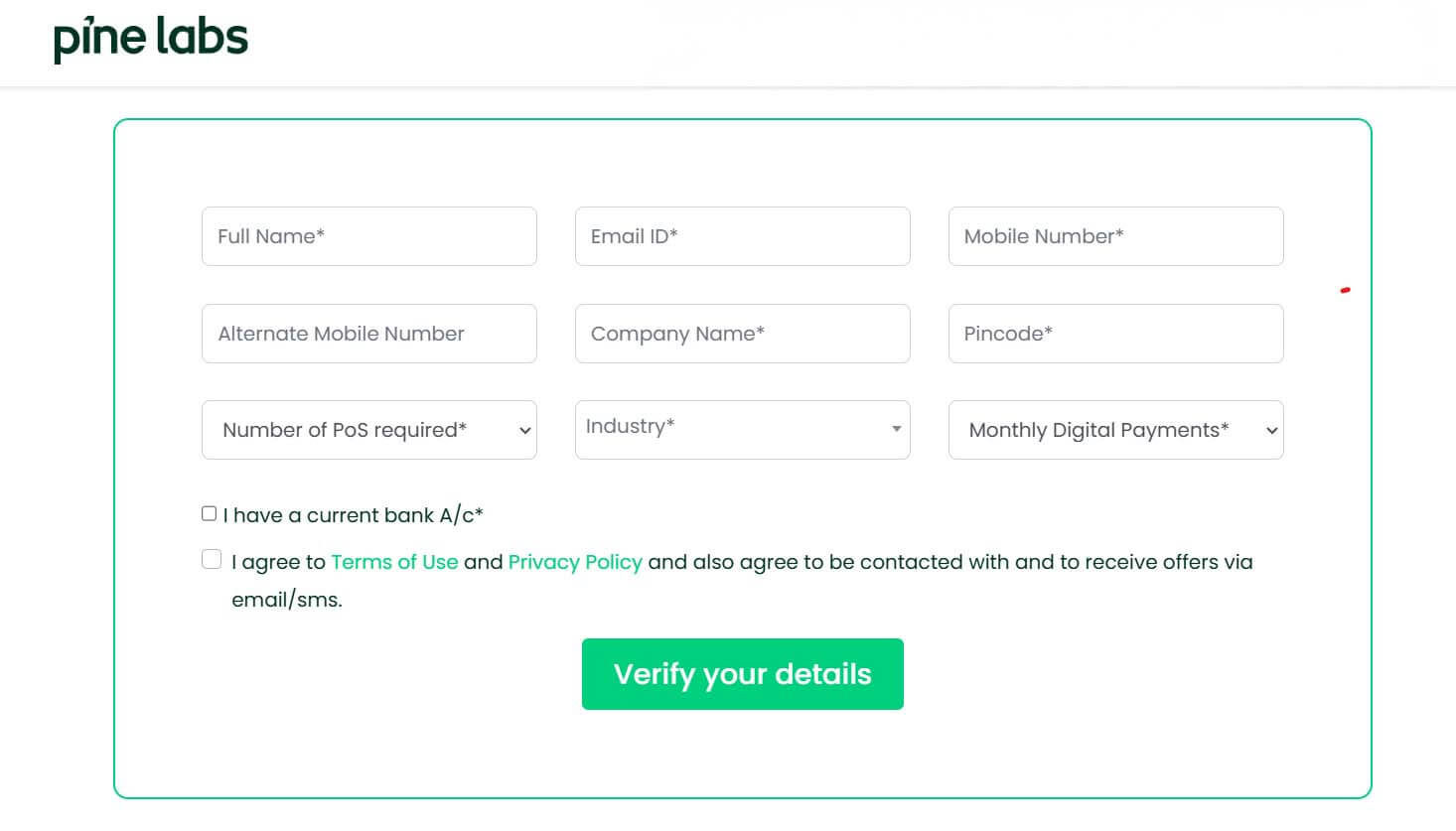

To address these challenges, Pine Labs partnered with Auriga IT to develop a streamlined digital onboarding solution compliant with RBI guidelines. This innovative system focuses on simplicity, accessibility, and speed:

- Simplified Documentation: Merchants can initiate POS or soundbox requests online. A Pine Labs salesperson then visits the merchant to collect necessary documents, such as PAN and bank details, and instantly generates the purchase order. Payments are facilitated through UPI or other secure methods with OTP verification. This process now completes Within same day, drastically reducing approval times.

- Enhanced Accessibility: The new system minimizes the need for technical expertise. Automated online steps are complemented by on-site support from sales personnel who handle document collection and verification through Penny Drop Verification. Dedicated assistance ensures smooth onboarding, even for those with limited digital skills.

- Streamlined Compliance: Pine Labs’ solution integrates regulatory requirements seamlessly, verifying documents in real-time to prevent delays. By ensuring all compliance steps are met efficiently, the onboarding process becomes both fast and hassle-free.

Outcomes

- Increased Merchant Adoption and Retention

- Enhanced Customer Satisfaction and Experience

- Improved Compliance, Enhanced Security and Fraud Prevention

- Scalability and Future-Proofing

Related content

Auriga: Leveling Up for Enterprise Growth!

Auriga’s journey began in 2010 crafting products for India’s [...]

Stay Close to What We’re Building

Get insights on product engineering, AI, and real-world technology decisions shaping modern businesses.