Savewallets

Product design and development to build an automatic saving & investment platform

- Digital Products & Software

About Client

Savewallets set out to tackle a widespread personal-finance challenge: most people intend to save at least 30 % of their income, yet only a fraction actually do. Their insight was simple—if saving happens automatically every time someone spends, it quickly becomes part of their daily routine. To achieve this, they needed a secure, bank-grade mobile experience that could aggregate accounts, track spending in real time, and divert micro-amounts into an investment wallet with zero friction.

How we helped

#Product Design | #Product Engineering

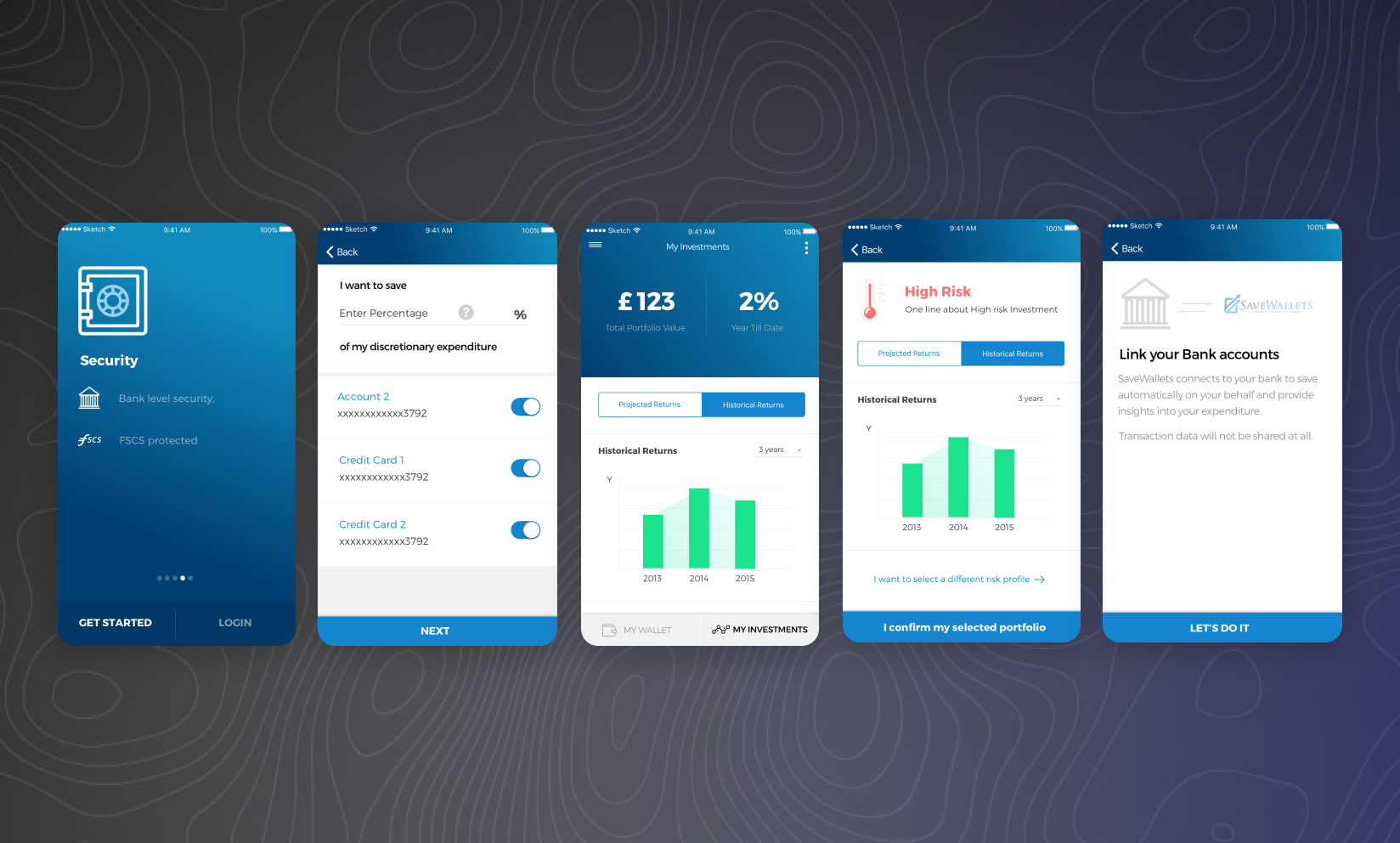

Our design team partnered with Savewallets’ founders to shape the entire user journey—from information architecture and user flows to high-fidelity wireframes and motion-rich visual mock-ups. We created a reusable UI library so new screens could be rolled out rapidly and remain consistent.

Our design team partnered with Savewallets’ founders to shape the entire user journey—from information architecture and user flows to high-fidelity wireframes and motion-rich visual mock-ups. We created a reusable UI library so new screens could be rolled out rapidly and remain consistent.

On the engineering side, we adopted an agile, sprint-led model to deliver a robust iOS app and cloud backend that securely handles sensitive financial data at scale. Key pillars included:

- Bank-Grade Security: Implemented PCI-DSS compliant payment flows, tokenized credentials, and at-rest data encryption to ensure maximum security.

- Real-Time Data Aggregation: Integrated with Yodlee to seamlessly ingest transaction data from linked debit cards, credit cards, and bank accounts.

- Automated Micro-Saving: Developed a rule-based engine to categorize spending, apply user-defined saving rules, and automatically transfer funds to a secure escrow wallet.

- Personalized Investment Guidance: Created a built-in risk profiling tool that recommends personalized asset allocations and projects long-term returns.

- Actionable Financial Insights: Designed a comprehensive expense manager to visualize spending by category and track investment portfolio growth.

Technical Highlights

• Yodlee-powered financial account aggregation for debit/credit/bank data

• PCI-DSS-compliant Mango Pay escrow for instant, low-cost fund transfers

• Custom expense-categorisation engine for granular spending insights

• Goal-based micro-saving rules linked to each spend category

• Real-time risk assessment and asset-allocation advisor

• AWS-hosted PHP (Yii) & MySQL backend with auto-scaling and secure S3 storage

Platform – iOS native app

Industry – BSFI

Services

Product Development

Enterprise IT Transformation & Automation

Related Case Studies

SLA Financials