Yes Bank

Automating Central Bank-Compliant Loan Document Generation for All Loan Types

- Digital Products & Software

Client Overview

YES Bank, established in 2004, is a prominent private-sector bank in India. Headquartered in Mumbai, it ranks as the 7th largest private sector bank by market capitalization (source: Forbes India). With over 1,100 branches and 1,800 ATMs spread across India, YES Bank serves millions of customers with an extensive portfolio of financial services, including loans, credit cards, mortgages, and investment options.

Problem Statement/Challenges

The Reserve Bank of India (RBI), on October 1, 2024, mandated that all banks and Non-Banking Financial Companies (NBFCs) provide a Key Facts Statement (KFS) at every stage of loan processing and whenever the conditions of the loan agreement change.

A Key Facts Statement (KFS) is a standardized document that provides borrowers with crucial loan details in a clear and concise format before signing any agreement with banks or NBFCs. This includes information on interest rates, all associated fees, penalties, and Equated Monthly Installment (EMI) amounts, enabling informed borrowing decisions.

To meet a tight deadline for complying with these new Reserve Bank of India (RBI) regulations, YES Bank partnered with Auriga IT to develop a standalone system for the automatic generation of Key Facts Statements (KFS) and loan agreements (a legal contract between a borrower and a lender). This system aimed to produce accurate and compliant KFS documents for all loan types, ensuring efficiency and regulatory adherence. However, YES Bank faced several significant challenges:

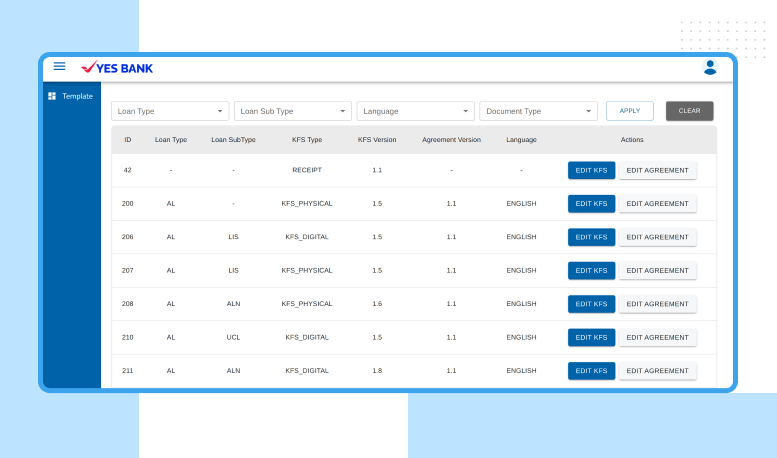

- Customization for Diverse Loan Products

YES Bank offers a wide array of loan products, each with unique features and terms, making the customization of KFS documents necessary. Developing and managing templates for various loan types added complexity to the system. - High Loan Volume

As the 7th largest bank in India, YES Bank processes a high volume of loans daily. Generating and delivering KFS documents for each loan, especially during peak seasons, presented resource and system limitations. - Compliance with Evolving RBI Regulations

Maintaining compliance with RBI regulations and ensuring the accuracy of KFS documents required constant updates and stringent auditing measures. This added a layer of complexity in maintaining data integrity and regulatory adherence.

Solutions

To address these challenges, YES Bank implemented the following innovative solutions:

- Centralized Regulatory Updates

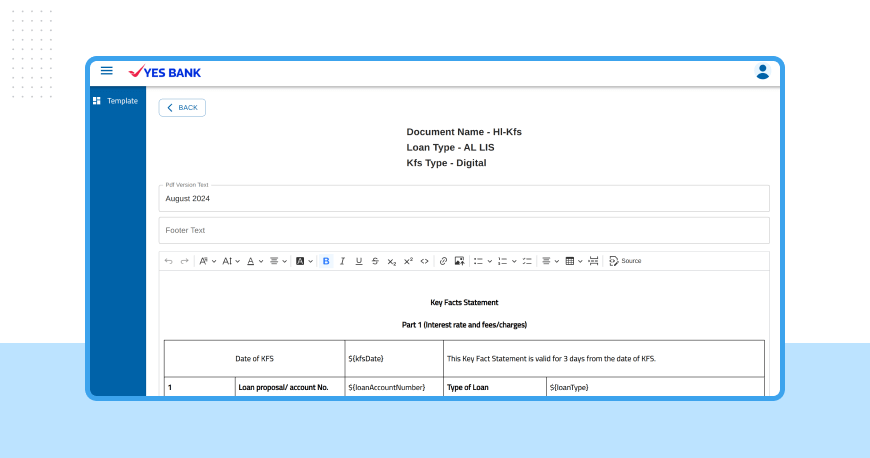

To manage frequent updates to RBI regulations, we created a centralized system that enables a designated “caretaker” to easily apply the latest regulatory changes. These updates automatically sync across all areas, ensuring that compliant KFS documents are generated and sent to all customers with minimal manual intervention. - KFS Document Editor

The KFS document editor streamlined the update process in line with new RBI guidelines:

- Makers (Business Owners) propose changes to KFS templates.

- Checkers (Regulatory Reviewers) verify and approve proposed updates to ensure compliance.

- Once approved, the changes are automatically incorporated into the final KFS document, ensuring accurate, compliant, and timely delivery.

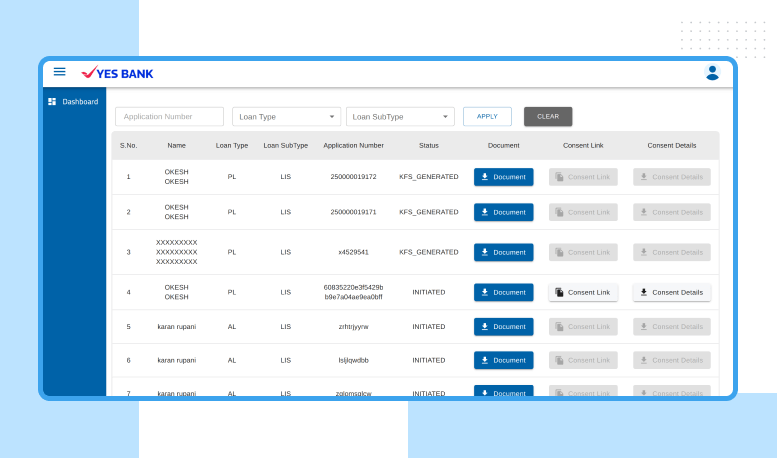

- KFS Portal for Agents

A user-friendly KFS portal for agents was developed to improve agent efficiency and customer communication:- View the full KFS history for each loan.

- Track consent status to see if customers have agreed to their KFS.

- Resend consent links to customers who have not yet accepted the KFS.

Project Outcomes

- Enhanced Transparency: Customers receive clear, concise, and standardized information about their loans.

- Improved Efficiency: Central system to manage & generate KFS documents on the go.

- Regulatory Compliance: Ensures adherence to the latest RBI guidelines.

Related Case Studies

SLA Financials