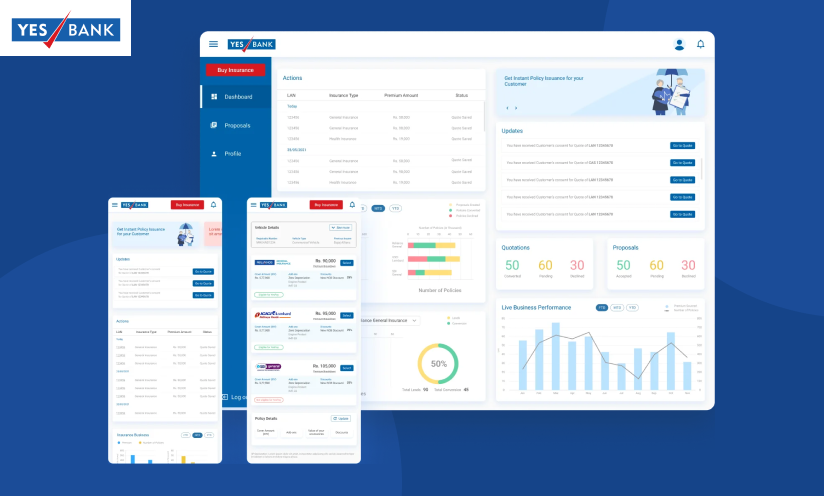

Yes Bank

Designed a Insurance Management Platform for Yes Bank

Project Brief

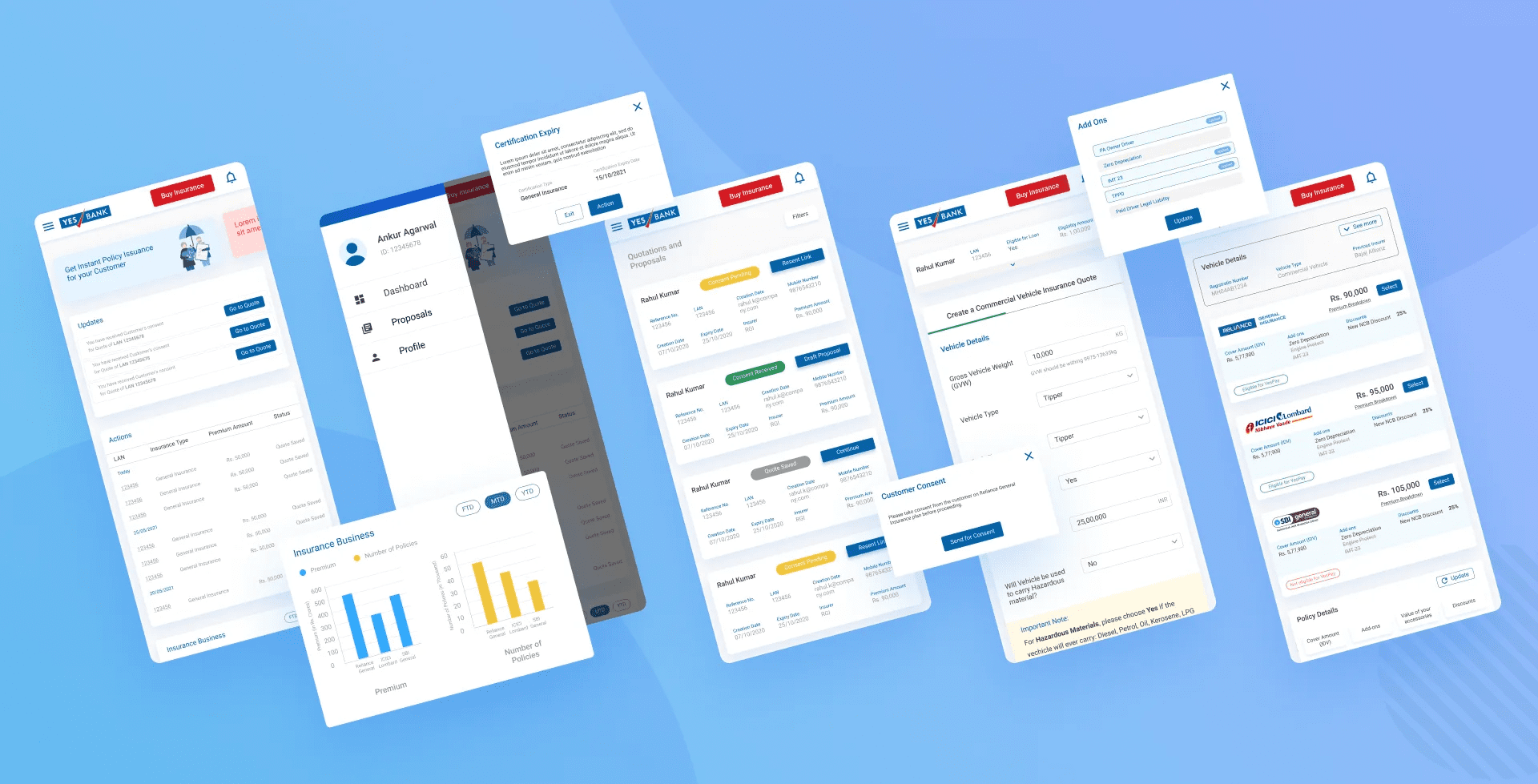

We worked with the Yes Bank team to build a new platform on which they can digitize the process of managing customer databases, insurance quote generation, customer approvals, insurance purchases, and communication.

Background

Currently, the insurance sale and data management at Yes Bank is paper-based. Bank representatives handling these operations meet customers offline, complete the paperwork, collect the data, and upload it to the bank’s system.

Building a platform to automate the insurance purchase flow will significantly reduce operations costs and improve productivity by reducing manual intervention.

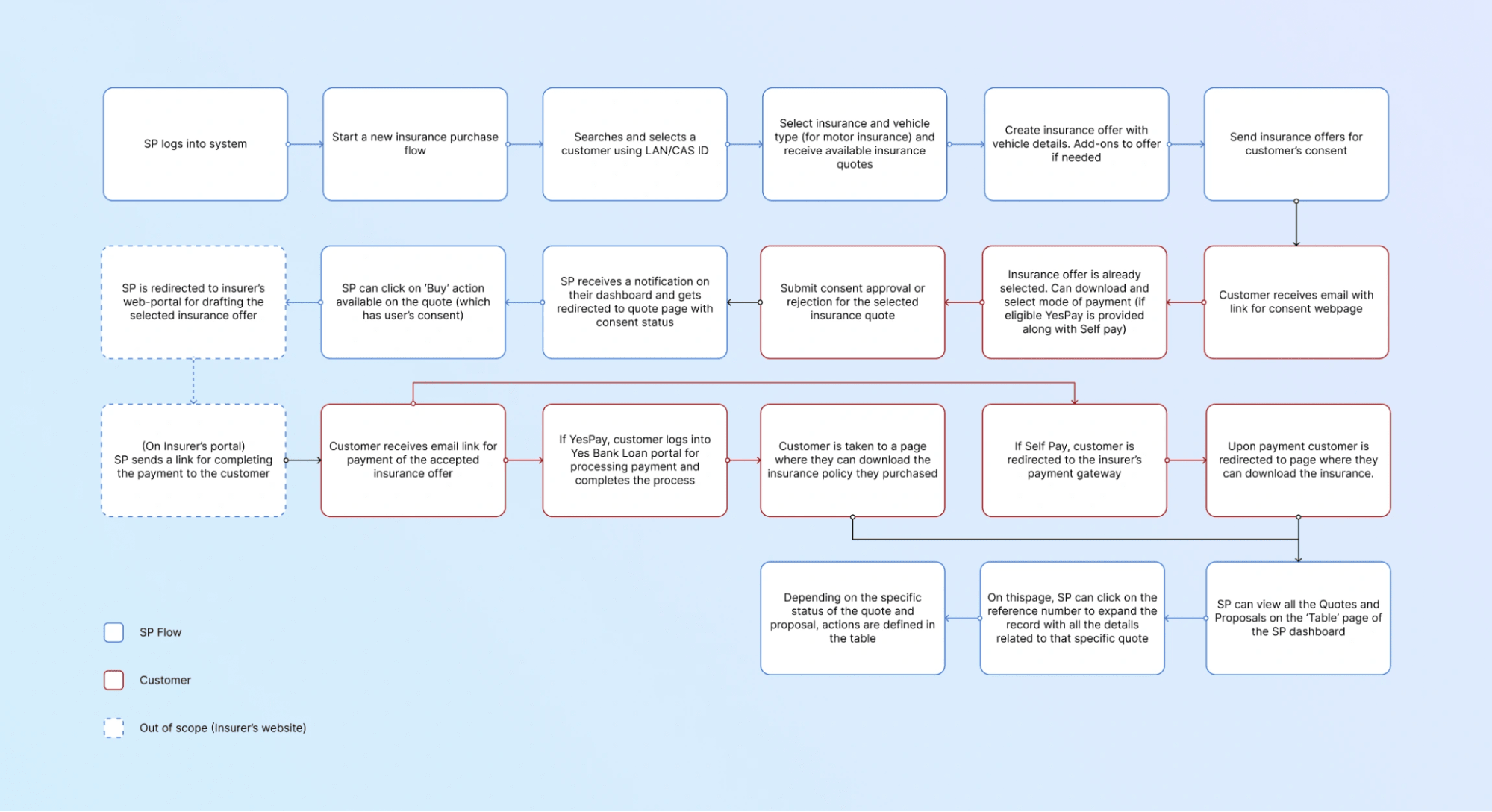

Task flows

Our primary goal is to assist Yes Bank agents in conducting their tasks effortlessly by automating most of the flow and empowering them in decision-making.

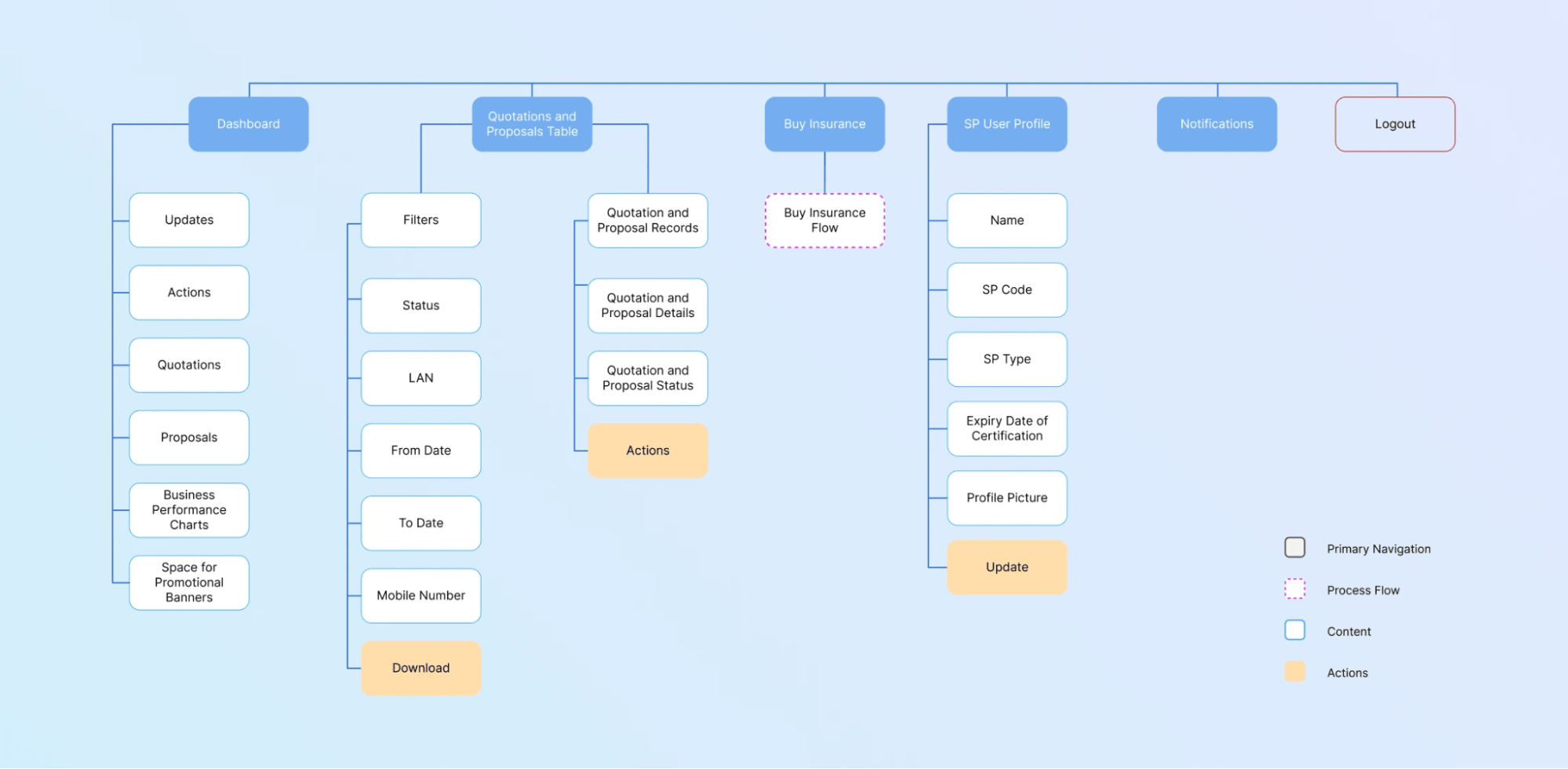

Information Architecture

We simplified the flow and system architecture by mimicking the offline steps from the operations to automate the flow so that the onboarding efforts are negligible and the users are already familiar with the system.

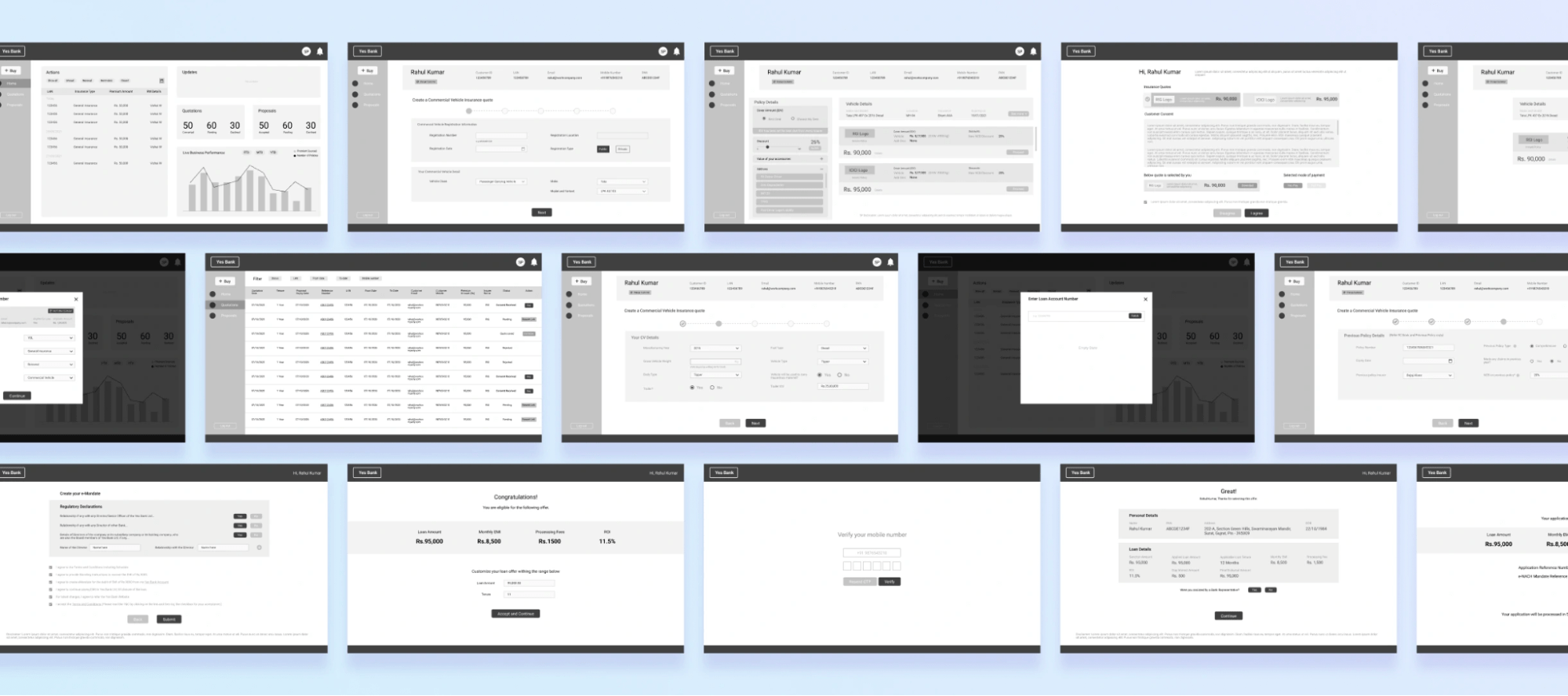

Wireframes

After thorough ideation and stakeholders’ feedback for the core system flow and information architecture, I used the information available to sketch the screen UI layout.

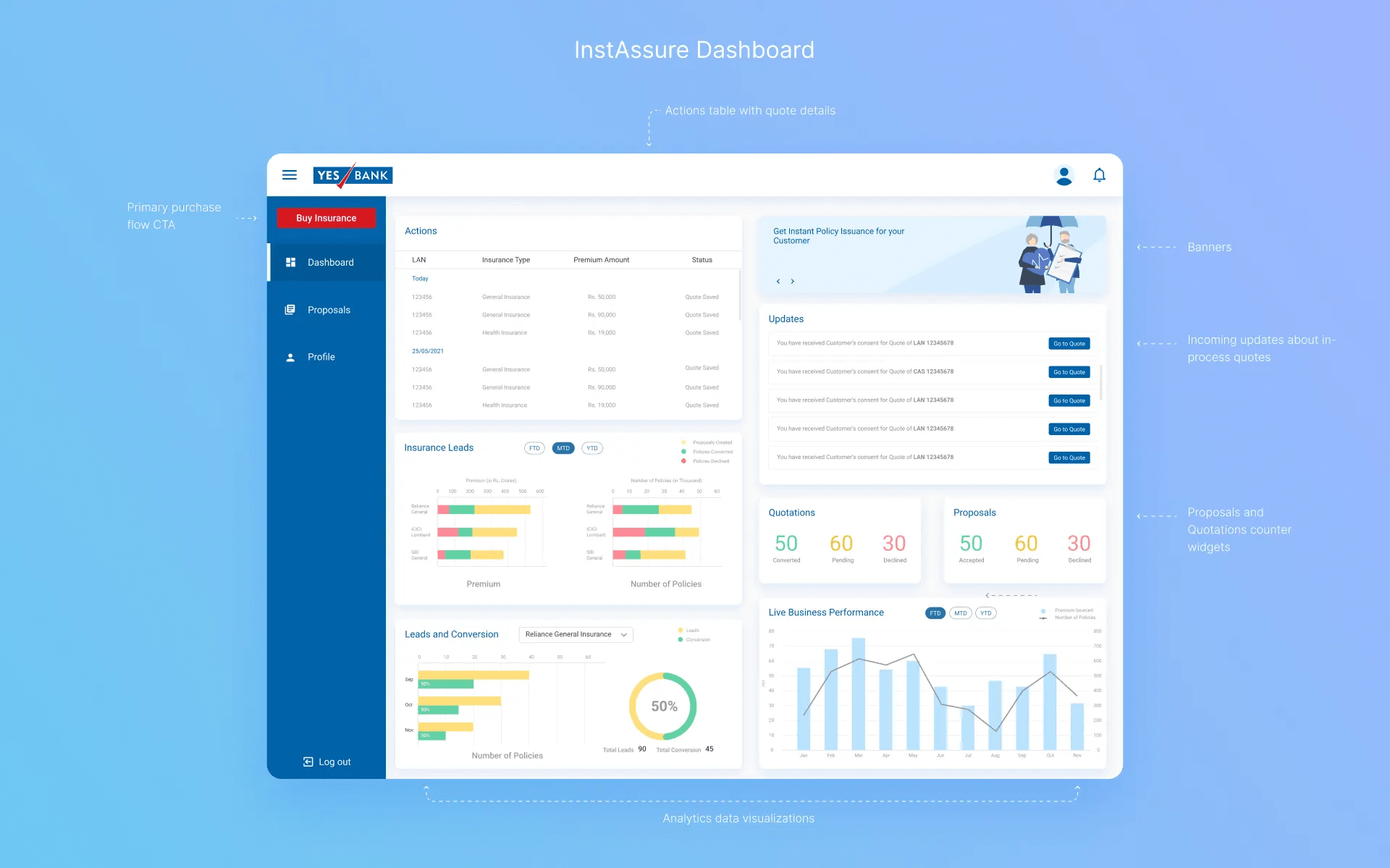

IntAssure dashboard

InstAssure Dashboard is the primary communication and action center for the user. They can see the overview of their business performance and receive updates and tasks to complete.

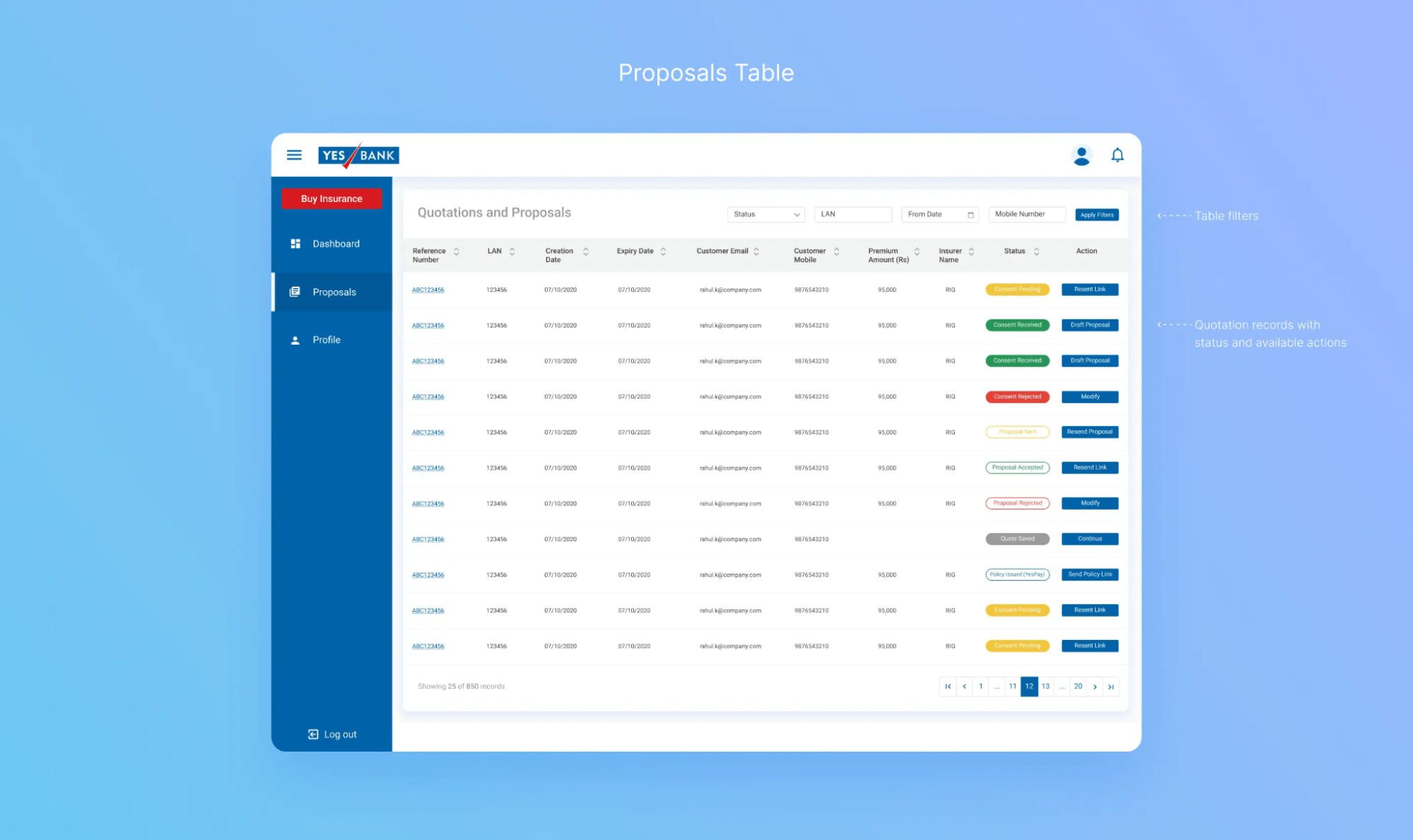

Proposals table

Users can manage quotations and proposals in the database. Quotations are the case requests sent by bank agents to customers, while proposals are those converted quotations that have received the user’s consent for processing.

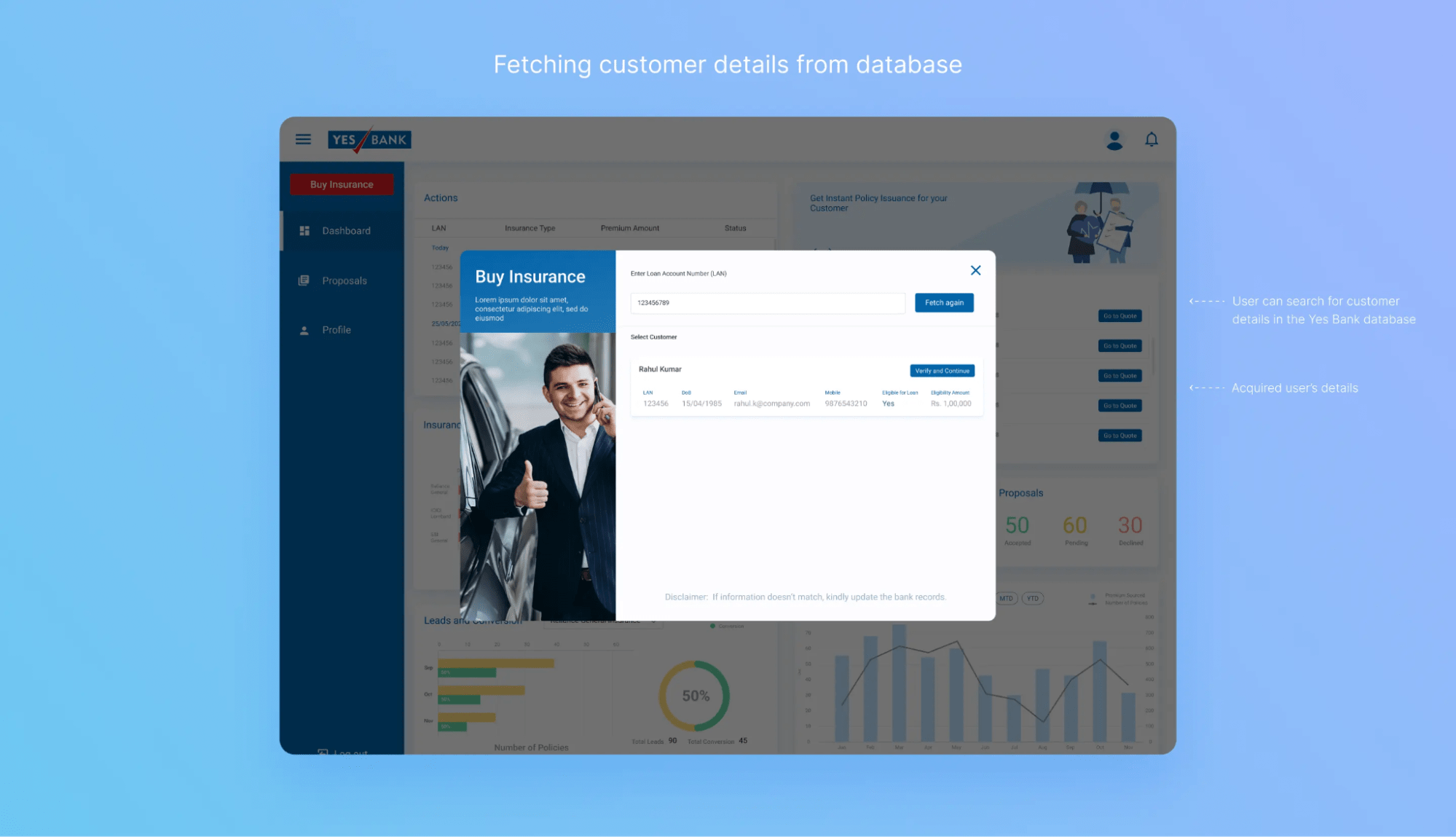

Creating a quote

The user creates a quote and sends it to the customer for their consent. They can identify customers based on an internal database and generate insurance quotations based on their needs. The system then sends the proposal to the respective customer for their consent.

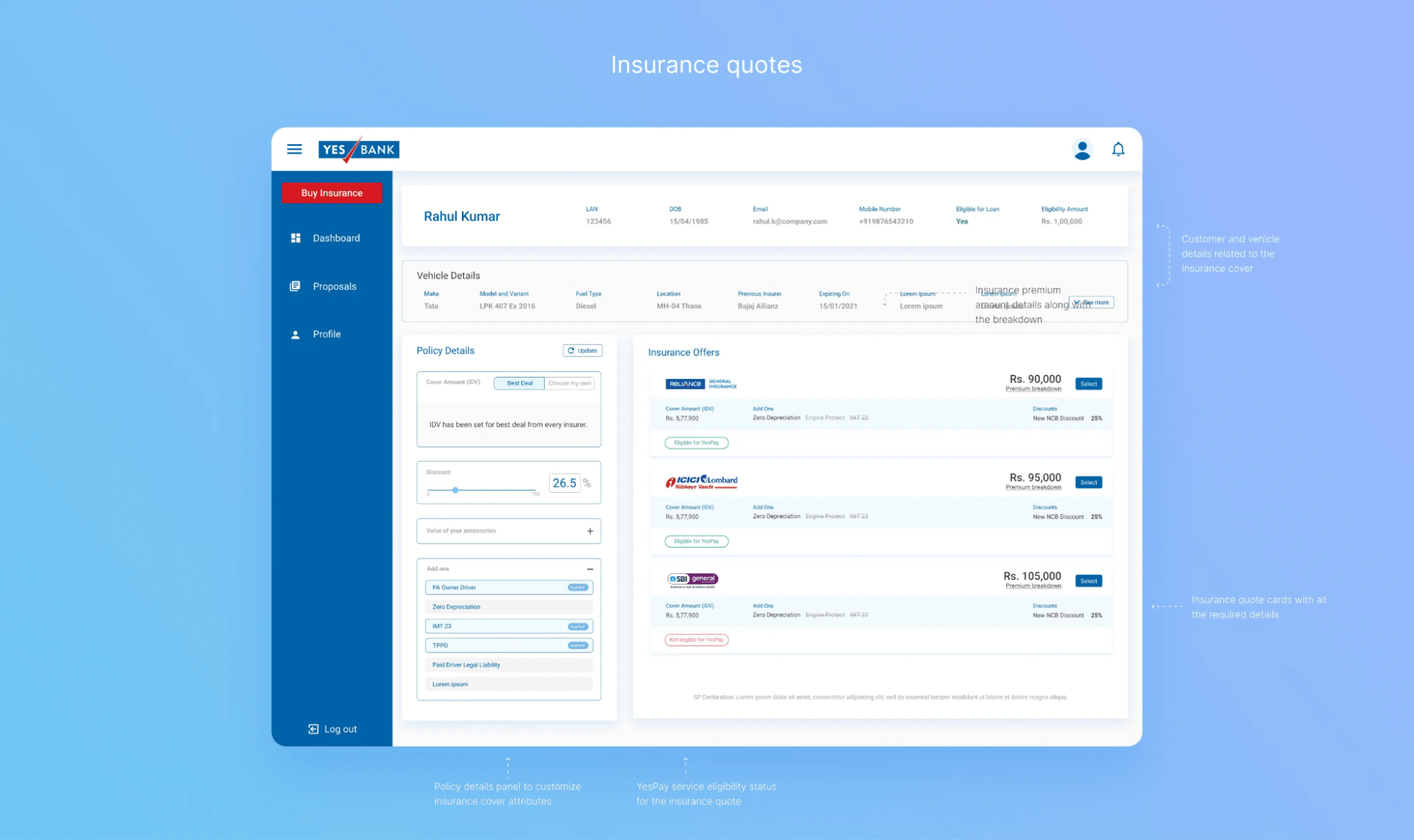

Insurance Discovery

This module helps the user to find appropriate insurance cover for the specific customer as they can customize and filter the attributes to generate the best insurance quotes.

Mobile screens

Related Case Studies

SLA Financials