Yes Bank

Developed Instant Loan Platform for Leading Bank

- Digital Products & Software

Overview

Loans can be a lifeline for people who want to achieve their dreams, whether it’s buying a new home, paying off debt, starting a business, or traveling the world. But getting a loan can be a hassle, especially if you have to deal with paperwork, delays, and high interest rates.

YES Bank, a leading financial institution in India, wanted to create a platform that offers instant bank loans to eligible customers. To achieve this goal, YES Bank collaborated with Auriga IT to develop a comprehensive solution that can easily provide loans to non-YES Bank customers.

Challenges

The main challenge was to create a platform that could offer instant loans to anyone, especially those who were not Yes Bank customers. Moreover, there were other challenges:

- Verifying Eligibility- Yes Bank needed a system that could verify the eligibility of borrowers based on their credit history, income, assets, and other factors, to determine whether they qualified for the loan and assess their ability to repay it.

- Fraud and Identity Detection- To combat bank fraud, Yes Bank required a Financial Crime Detection and Management Solution that could detect defaulters, verify documents, and other details provided by the customers when they applied for a loan.

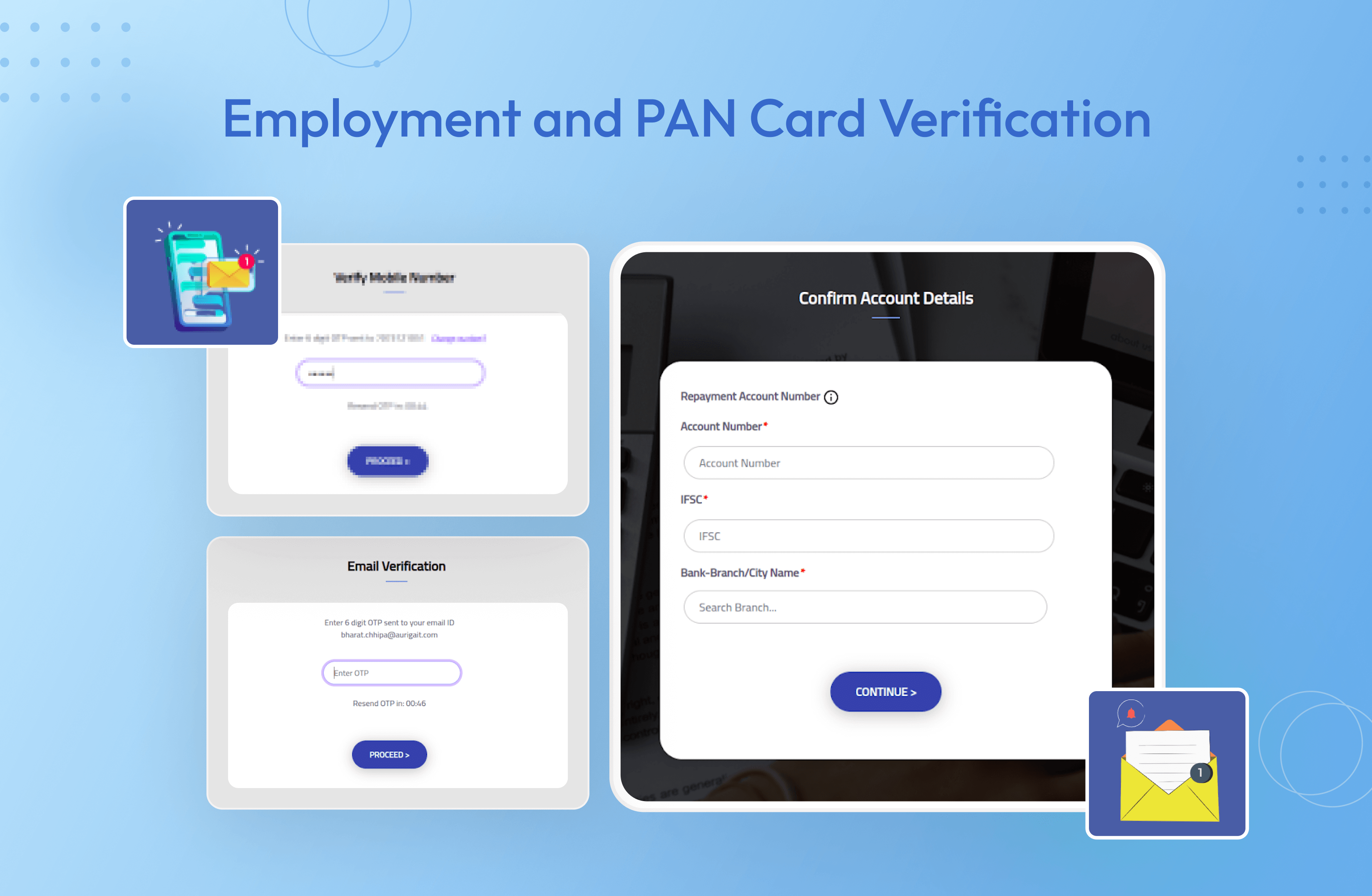

- Name, Address & Employment Verification-To prevent identity theft, Yes Bank required a system that could cross-check the loan applicant’s name, phone number, address, and employment status with various government agencies.

- Instant Bank Account Confirmation- To receive the loan reimbursement, the borrowers had to provide a bank account and Yes Bank needed a system to confirm that the account holder’s name matched the borrower’s name.

Solutions

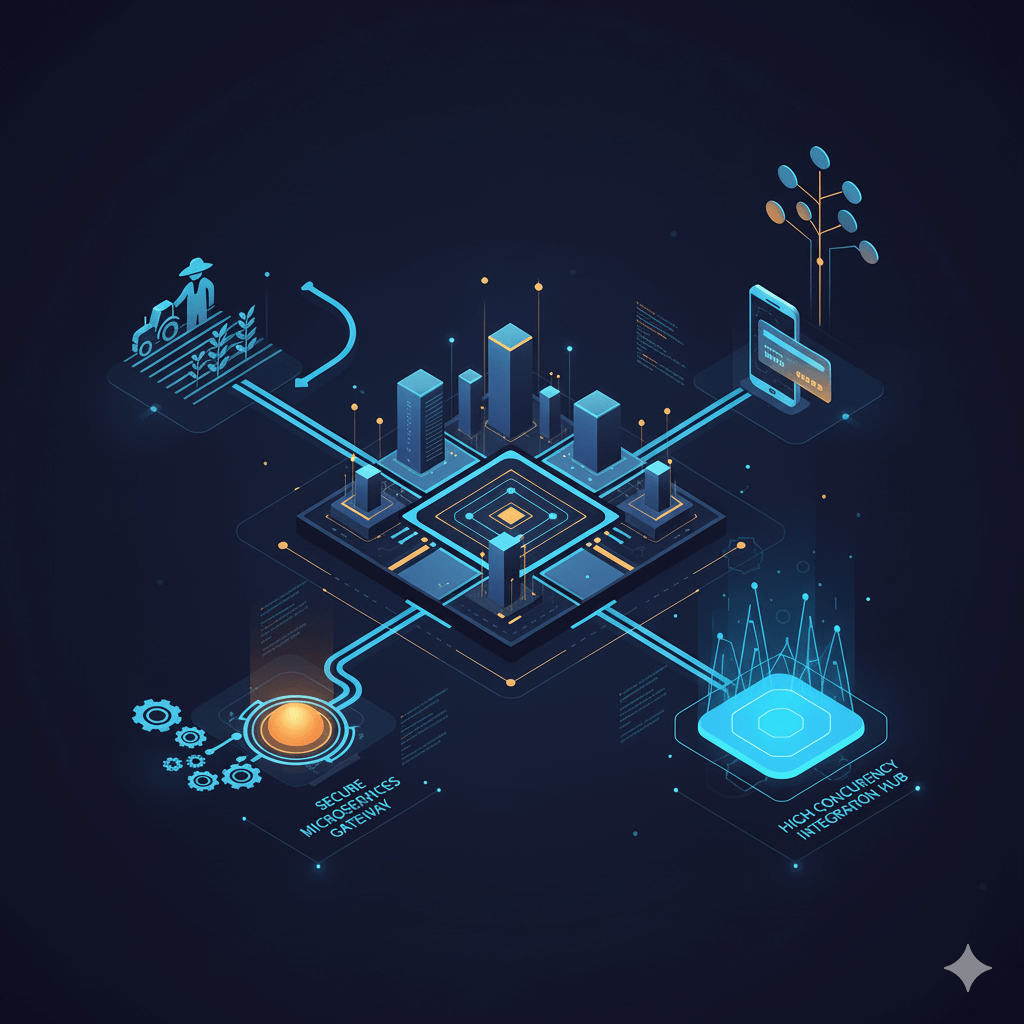

Yes Bank and Auriga IT collaborated to develop a Gennext solution that allowed customers to access instant and hassle-free loans in seconds to meet their immediate financial needs. To ensure this process is fraud-proof and smooth, Auriga IT designed the following solutions:

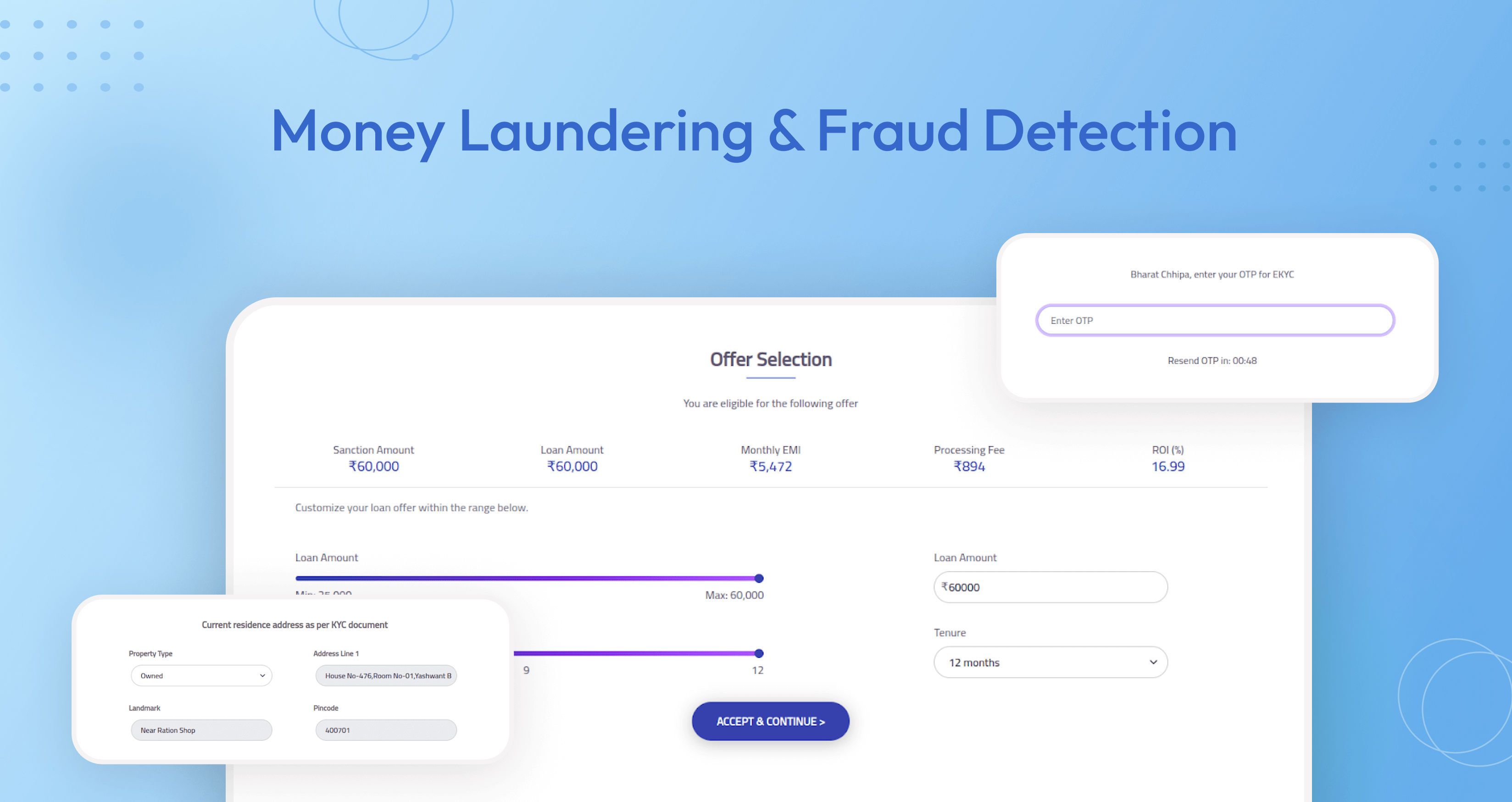

- Money Laundering & Fraud Detection – To prevent money laundering and fraud, Auriga IT integrated a solution that monitors transactions and flags suspicious patterns and a solution that identifies fraudulent applications into the Yes Bank Gennext platform.

- Employment and PAN Card Verification– To verify the employment details and to check that the borrowers’ company is not in the de-list group, Auriga IT employed APIs to authenticate the employment identity and PAN card information.

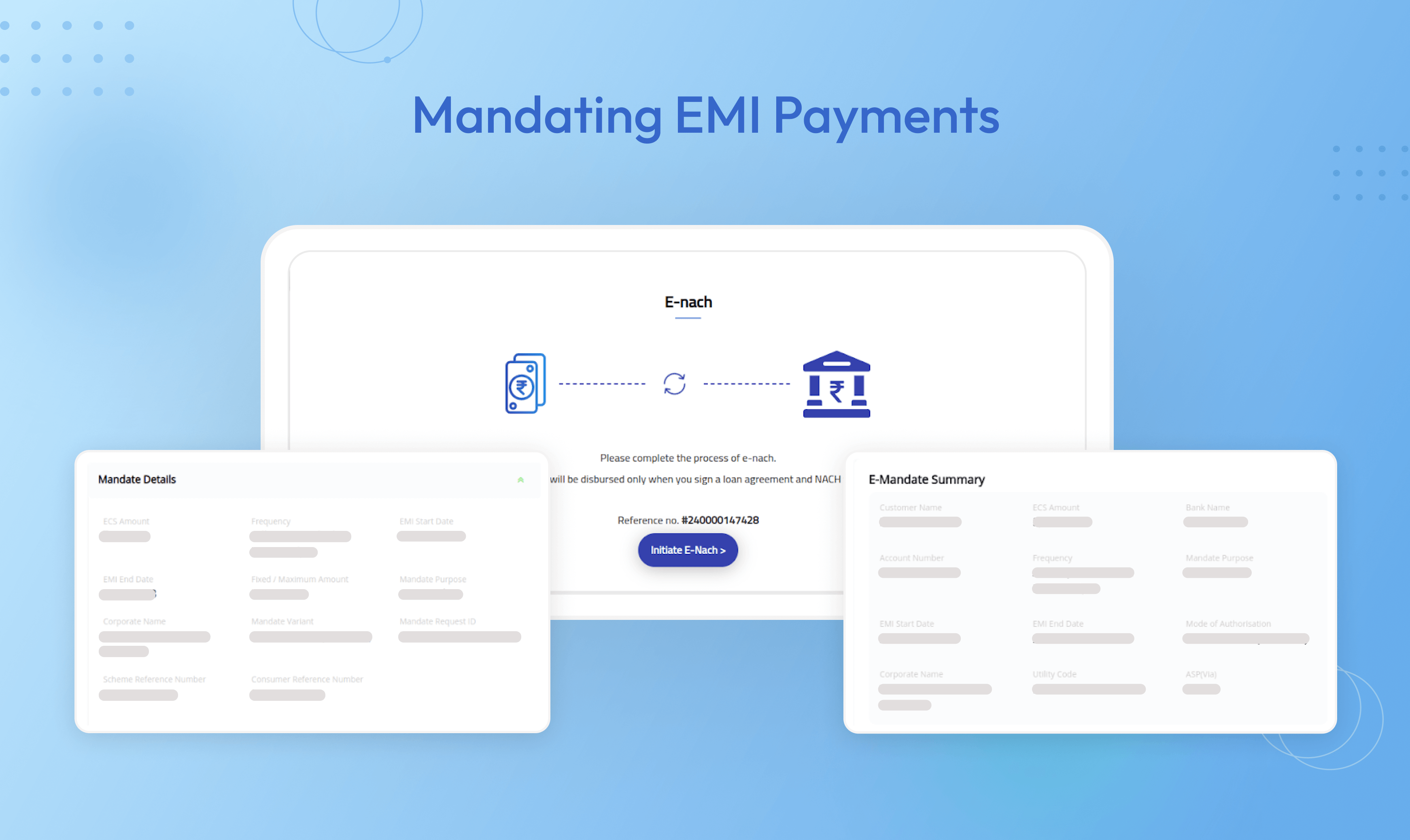

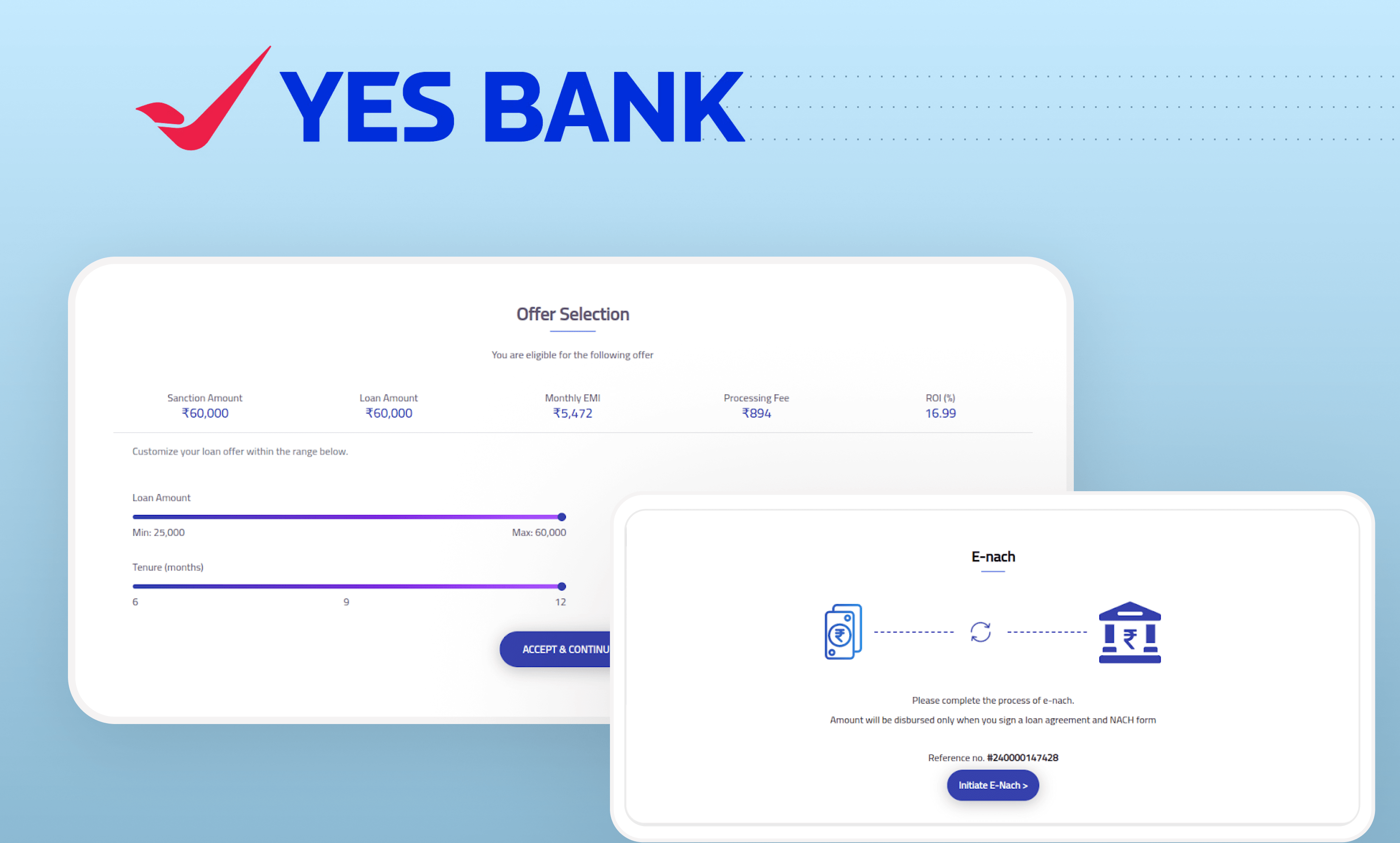

- Mandating EMI Payments- After the loan was reimbursed, a system was needed to authorize recurring payments. For this, we used E-NACH, which automated the recurring payments from the borrower’s side.

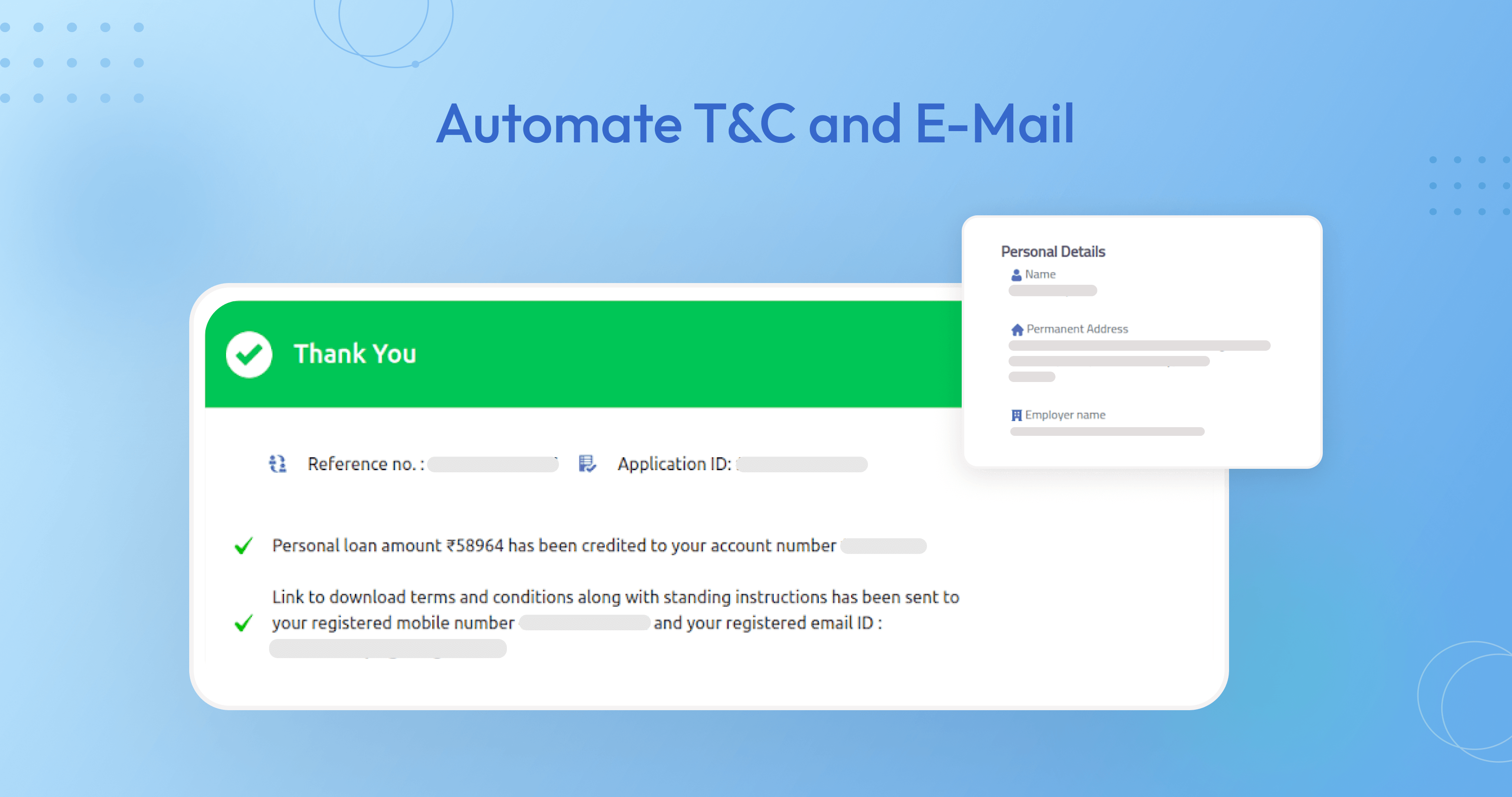

- Automate T&C and E-Mail – After finalizing everything, our solution sends an automated email with all Terms and Conditions and details of the approved loan. This is a dynamic email that is generated based on the amount and other criteria of the borrower.

Project Outcomes

- Made Everything Digital- With Gennext, eligible individuals can access instant loans up to Rs 60,000 without any human intervention, making the whole process fast and error-free.

- Automated Everything- The platform also automated the recurring payments and the email communication with the borrowers. The Gennext platform made the loan process fast, easy, and secure for both the customers and the bank.

Related Case Studies

SLA Financials