ICICI Prudential

Digital Transformation of Self-Buy Journeys for ICICI Prudential BOL Products

- Digital Products & Software

ICICI Prudential Life Insurance Overview:

ICICI Prudential Life Insurance is one of India’s leading life insurance providers, formed in 2000 as a joint venture between ICICI Bank and Prudential Corporation Holdings. With over 400 branches nationwide, the company offers a diverse range of life, health, and pension products to millions of customers.Backed by global expertise from Prudential, the company ensures trust, stability, and cutting-edge services for its clients.

Executive Summary

ICICI Prudential’s BOL team manages all direct-to-consumer (D2C) self-buy journeys across insurance products. With a growing need for better user experience, faster releases, and platform compliance with AEM standards, the company initiated a year-long digital transformation project. The goal: rearchitect the platform using modern tech and best practices without compromising business continuity.

The transformation delivered a modular, scalable, and high-performing front-end integrated with AEM and optimized for SEO and faster load times. It reduced customer-facing errors, improved time to production, and restored stakeholder confidence through better processes and documentation.

The Challenge

Business Drivers

- Poor user experience and performance on both AEM and non-AEM pages

- Long time-to-production due to lack of standardized development and release practices

- Low conversion and customer retention

- High reliance on development teams for even minor content updates

- Business continuity was non-negotiable — any production outage would directly impact revenue and customer trust

Core Challenges

- Legacy & Knowledge Gaps: No functional or technical documentation existed. Stakeholders had only partial understanding of existing logic.

- Testing Inefficiencies: QA lacked reliable test cases or coverage insights, increasing risk.

- Performance & SEO: Existing implementations had load delays, poor Lighthouse scores, and heavy, inefficient integrations.

- Volatile Requirements: Product teams frequently changed requirements even during active transformation.

- Cross-Functional Complexity: Multiple stakeholders from diverse departments had to sign off before production.

Execution Approach

The team followed a phased rollout strategy, starting with two of the most business-critical and technically complex products. The learnings and reusable components from these two cases set the foundation for scalable transformation across the remaining journeys.

Methodology

- Reverse engineering of current journeys

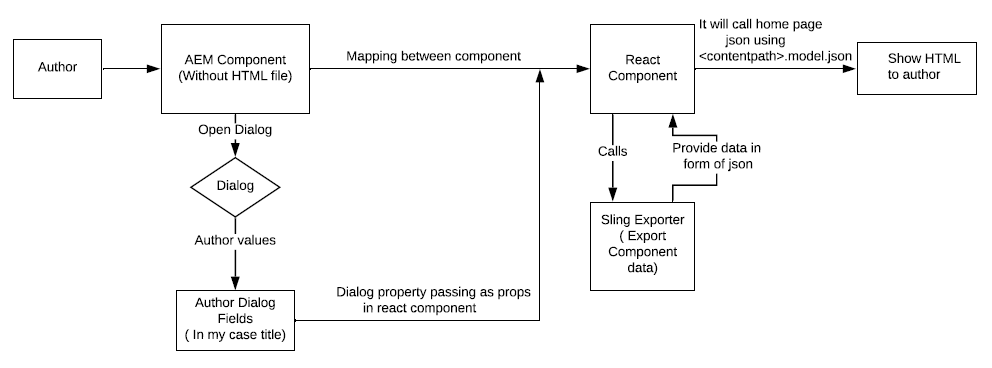

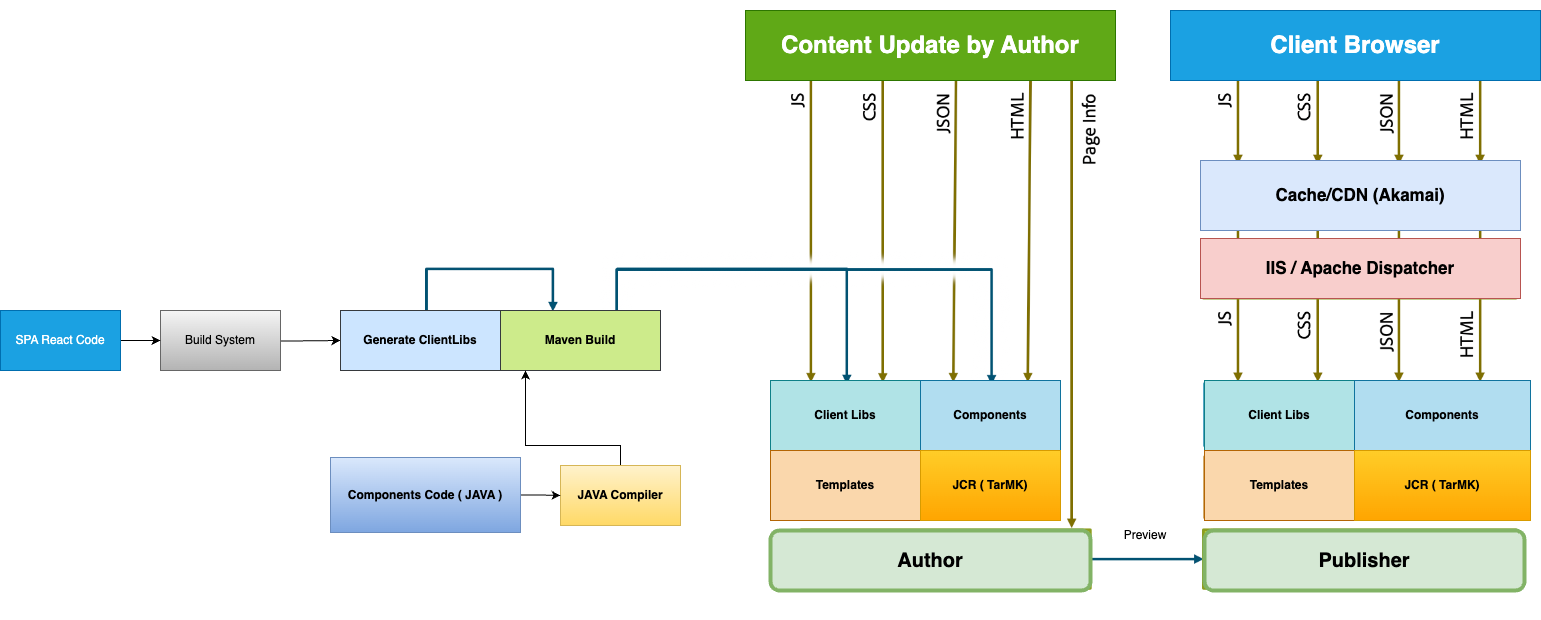

- Setup of reusable, modular components using React JS and AEM SPA Editor

- Clear documentation and sign-off framework

- Strong focus on reusability, maintainability, and configuration-driven behavior

- Standardized CI/CD pipeline with change management controls

Key Workstreams

- Product Discovery & Wireframing

- Component Development (Landing, Quote, Application Form)

- API Integration & Optimization

- Performance & SEO Tuning

- QA/UAT with Enhanced Testing Practices

- Stakeholder Sign-offs and Controlled Go-Live

Tech Stack

- Frontend: React JS SPA

- Backend Integration: AEM 6.5 On-Prem with SPA Editor

- Others: Akamai CDN, SEO tools, Analytics & CRM Integration

Risks & Mitigation

| Risk | Mitigation |

|---|---|

| No documentation of existing flows | Reverse engineering + stakeholder inputs |

| Risk of performance degradation | Load testing & optimization during UAT |

| Go-live impact on revenue-critical journeys | Parallel run with rollback strategy |

| Ever-changing product requirements | CR tracker + agile re-planning process |

Results & Impact

Business Outcomes

- Transformed all targeted journeys with zero production outages

- Reduced customer support tickets due to improved stability

- Achieved faster go-to-market timelines for new features

- Empowered business teams via AEM Authoring

- Enabled future migration to AEM Cloud

Quantitative Gains

- Page Load Time: Improved drastically with no loaders or lags

- Deployment Confidence: Stronger release process and rollback safety

- Error Rate: Significant drop in customer-reported journey issues

Stakeholder Recognition

- Project team received high praise from ICICI’s business and IT leaders

- Recognized for technical depth and professionalism

- Led to expansion of project scope and new business within the client organization

Lessons Learned

- Invest in functional documentation from the start

- Modular architecture and reusability significantly reduce future effort

- Strong change management is essential when working with frequently changing business requirements

- Early focus on non-functional aspects (performance, SEO, analytics) pays dividends post-launch

Conclusion

This digital transformation initiative successfully redefined ICICI Prudential’s self-buy platform — making it more agile, maintainable, and customer-focused. It not only modernized the underlying tech but also reshaped the development culture around clarity, quality, and speed.

Related Case Studies

SLA Financials