YesBank

Launched multiple digital services for Yes Bank customers

- Digital Products & Software

YesBank is one of the largest banks of India and offers personal banking, corporate banking & internet banking services, including accounts, deposits, credit cards, home loans, and personal loans.

Yes Bank was planning to launch new customer services to increase revenue streams and improve customer experience at all their touchpoints. They were looking for a partner with expertise in designing B2C products and services, as today’s customers expect an experience that is hard to find in legacy platforms.

Yes Bank selected Auriga as one of their preferred Technology vendors since Auriga has experience of designing solutions for leading product companies (such as Ola, Practo, Meesho, Zomato, Quikr, and Grofers), helping them improve the experience of customers and accelerate the Digital Transformation journey.

How we helped?

Experience Design | #Platform Engineering | #Platform Maintenance

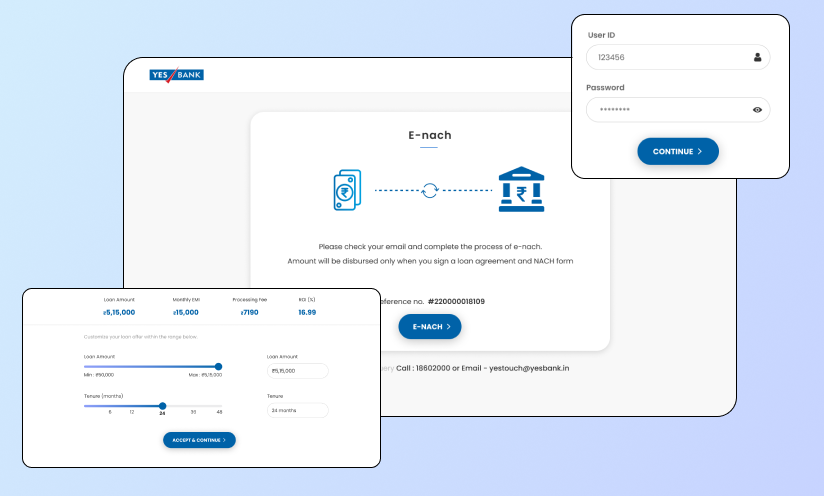

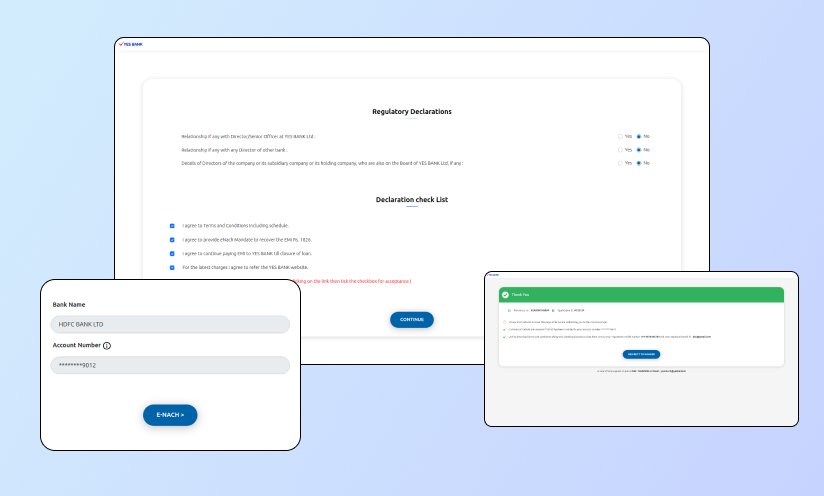

Auto Loan Top Up

YES Bank offers an Auto Loan Top-Up facility to all customers who require additional funds. They required a system where customers could easily avail loans without documentation. We developed an Auto Loan Top-Up panel where Yes Bank customers can choose the loan amount and tenure. Additionally, we integrated eNach (a tool to automate and handle all recurring payments) to allow customers to authorize the bank for EMI deductions. Furthermore, we incorporated e-Stamping (an online method of paying stamp duty to the government) for seamless payment of stamp duty to the government.

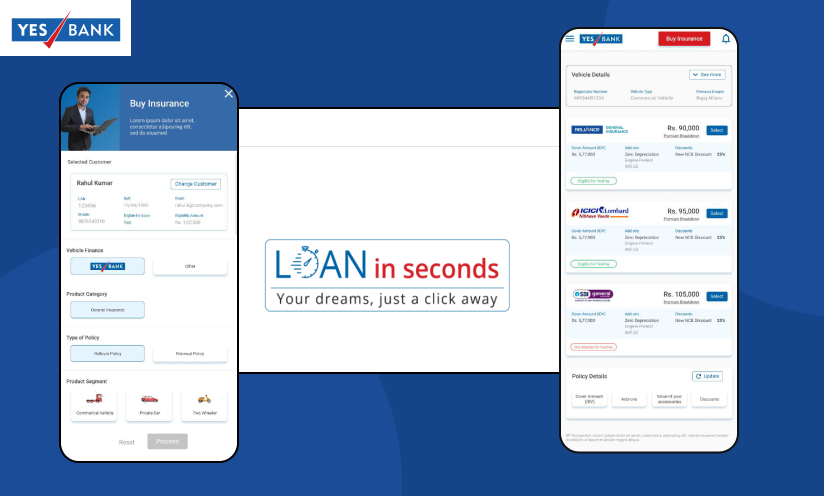

Auto Loan / CV loan as Insurance Premium

Many customers prefer not to pay the insurance amount at a single time when they buy a new vehicle. For this, Yes Bank offers individuals the option to obtain a loan for their insurance premium. To address this, we developed a solution allowing customers to calculate a customized quotation & choose a loan payment method for their insurance premium & integrated Karza (cloud-based tool used to authenticate more than 15 KYC documents) to authenticate KYC documents in real time

MSIL Integration Auto Loan

When a customer buys a vehicle from a dealer, he can book a vehicle and select the financing bank from the dealer panel directly. Yes Bank needed a system to integrate with MSIL (MARUTI SUZUKI INDIA LIMITED) to process all auto loan applications at the dealer end. We developed a platform that can be easily integrated with the dealer panel, automatically fetch CIBIL scores & perform business logic checks. We also integrated CRM on the dealer panel, First-factor authentication & offer calculation on the go. In just six months since its launch, the YESRace platform facilitated loan disbursal worth INR 500 Cr, showcasing its remarkable impact.

Pre-approved Auto Loan (DIY)

Securing an auto loan has never been easier for YES BANK’s account holders. Our streamlined process allows customers to follow a few steps and easily obtain a loan, eliminating the need for time-consuming paperwork. Our user-friendly approach ensures a seamless and efficient experience, empowering customers to fulfill their auto financing needs quickly and conveniently.

As a trusted partner, Auriga has worked with YES Bank LTD to design and develop multiple applications(YBL Reporting & Insurance Management Platform) in the lending domain, driving innovation in the financial sector.

Highlights

- Yes Race is is now processing loan amount of INR 300 crore every month

- With our system, Yes Bank processed over INR 26 crore pre-approved loans in the financial year(2021-22)

- Yes Bank received over 15k+ applications for auto loans with the YesRace platform.

As a trusted partner, Auriga has worked with YES Bank LTD to design and develop multiple applications(YBL Reporting & Insurance Management Platform) in the lending domain, driving innovation in the financial sector.

Related Case Studies

SLA Financials