- Digital Products & Software

Secure Social Financing and Loan Management

Secure Social Financing and Loan Management

About the Client:

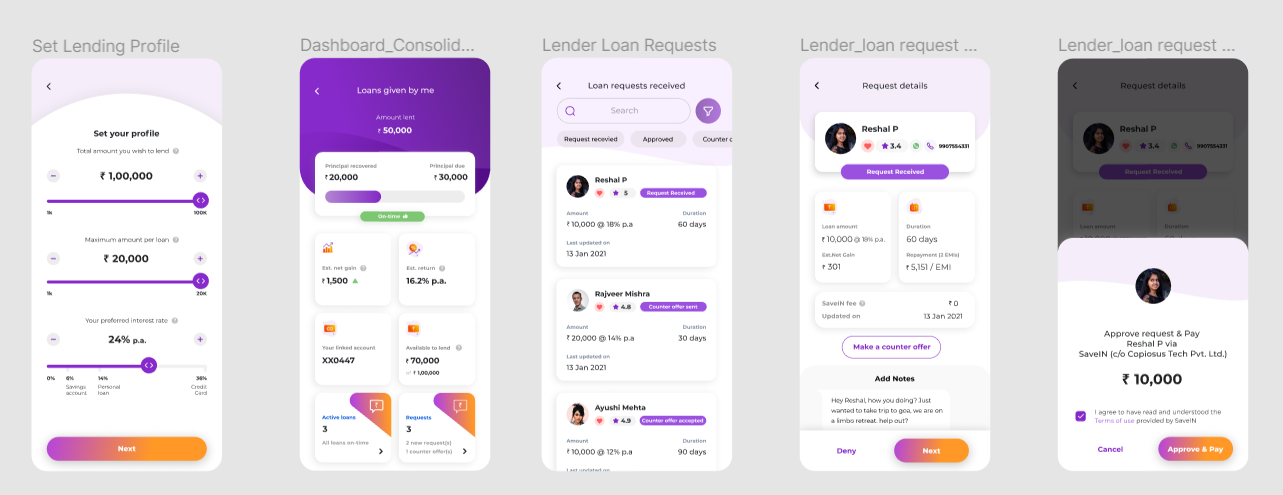

SaveIn is a financial services platform which provides social financing and loan management facilities to its customers by providing them with a full online banking experience. With a focus on providing secure, efficient, and accessible financial services, SaveIN aims to disrupt traditional banking by leveraging technology to address the diverse needs of its customers with key focus on peer to peer lending by catering to both borrowers and lenders in a secure, compliant, and user-friendly platform.

Project Objective:

The objective of this project was to build a robust, secure, and scalable digital platform that supports social financing, facilitating the discovery and matchmaking of lenders and borrowers. In addition, the platform needed to include a comprehensive loan repayment framework capable of handling millions of repayments and a notification system for effective debt recovery and collection. The ultimate goal was to provide an easy-to-use yet secure environment for users to lend, borrow, and manage loans effectively while ensuring compliance with regulations and robust security.

Solutions:

- Secure Social Financing Platform:

The core functionality of the SaveIN platform revolves around securely connecting borrowers and lenders through a social financing model. This feature includes:

-

- Borrower-Lender Matchmaking: A secure discovery and matchmaking engine that helps borrowers find suitable lenders and vice versa, based on parameters like loan amount, duration, creditworthiness, and interest rate preferences.

- Secure Transactions: All transactions between borrowers and lenders are secured through encrypted communication and real-time identity verification, ensuring compliance with KYC regulations.

- Peer-to-Peer Lending: A feature that allows individuals or entities to lend money directly to borrowers, bypassing traditional financial institutions and offering better rates for both parties.

- Loan Repayment Framework:

To handle the complexities of loan management, a comprehensive loan repayment framework was developed, which includes:

-

- Automated Loan Amortization Schedule: The system automatically generates a loan amortization schedule, outlining the principal and interest payments over the loan’s term. This feature ensures both the lender and borrower understand their repayment obligations from the start.

- Millions of Repayments Handling: The system is built to scale, efficiently handling millions of loan repayments across multiple users. It ensures accurate tracking of payments and updates on loan balances in real time.

- Partial Payments & Flexibility: Users can make partial payments, with the system dynamically updating their repayment schedule based on the amount paid.

- Robust Notification Framework for Debt Recovery and Collection:

To ensure timely repayment and prevent defaults, a comprehensive automated notification system was implemented:

-

- Automated Reminders: The system sends automated reminders to borrowers for upcoming repayments, overdue payments, and delinquent accounts. Notifications are sent via email, SMS, and in-app alerts.

- Escalation Notifications: If a borrower misses multiple payments, the system escalates the notification, alerting the borrower about the risk of penalties or collection actions. It ensures proper documentation and communication for debt recovery.

Technical Highlights:

- Secure Authentication & Authorization:

-

- O-Auth PKCE Security Extension: The platform uses OAuth 2.0’s PKCE (Proof Key for Code Exchange) extension to enhance the security of the authorization process, particularly in public clients, ensuring robust defense against malicious interception.

- Multi-Factor Authentication (MFA): Both biometric and password-based authentication mechanisms are implemented for securing user accounts. This ensures that only authorized users can access sensitive information and perform critical actions such as loan disbursements and repayments.

- Scalability with AWS Solutions:

-

- AWS Cognito: Used for secure and scalable user authentication and identity management, ensuring that users can safely log in to the platform using their social media accounts or bank credentials.

- AWS Fargate: AWS Fargate is used for managing containers, providing an efficient and scalable compute engine for running microservices without managing infrastructure.

- AWS Lambda & SQS: AWS Lambda is used to run backend code in response to events like user requests and repayments, while Amazon SQS handles the queuing of tasks for asynchronous processing.

- AWS Load Balancer & WAF: A load balancer is employed to distribute incoming traffic across multiple servers, ensuring high availability and preventing server overloads. The AWS Web Application Firewall (WAF) is implemented to protect the platform from malicious attacks and ensure safe interactions with the app.

- AWS CloudWatch: Used for monitoring and logging real-time system performance, ensuring that the platform is always up and running, with detailed metrics for troubleshooting and performance optimization.

- Security Measures:

-

- Rate Limiting: The platform employs rate limiting on each API to prevent DDoS (Distributed Denial-of-Service) attacks and ensure fair usage. This prevents malicious actors from overwhelming the system by flooding it with requests.

- App-Wide Screenshot Prevention: To protect sensitive user information, the app employs screenshot prevention techniques, ensuring that no part of the user’s data is exposed or captured through screenshots.

- Code Obfuscation: A strategy of code obfuscation is employed to make it difficult for unauthorized individuals to reverse-engineer or tamper with the application’s code, enhancing its security posture.

- Comprehensive Data Encryption: All sensitive data, including financial transactions, user profiles, and communication, is encrypted both in transit and at rest using industry-standard AES-256 encryption.

Results:

- Increased Platform Security: By employing advanced security measures like OAuth PKCE, MFA, and encryption, SaveIN ensured that the platform is secure, protecting sensitive user data from unauthorized access and malicious attacks.

- Seamless Social Financing Experience: The matchmaking system effectively connected borrowers and lenders, facilitating peer-to-peer lending and expanding access to loans. This feature contributed to an increase in platform user engagement and satisfaction.

- Efficient Loan Management: The loan amortization framework enabled SaveIN to manage millions of loan repayments with ease. The system’s ability to handle partial payments and generate accurate repayment schedules significantly reduced manual intervention and errors.

- Improved Debt Collection Efficiency: The automated reminder system for debt recovery improved loan repayment rates and minimized defaults. The platform’s integration with debt recovery agencies allowed for smooth transitions in delinquent account handling, contributing to better financial health for SaveIN.

- Scalability & Performance: Leveraging AWS’s robust cloud infrastructure, SaveIN was able to scale its platform dynamically, ensuring smooth operation even during peak usage times. AWS services such as Fargate, Lambda, and SQS provided the scalability and flexibility needed to handle growing user demands and increasing loan volumes.

- User Trust & Satisfaction: With strong security measures, seamless functionality, and the ability to handle millions of repayments, the platform built a high level of user trust and satisfaction, contributing to increased user retention and positive customer feedback.

Conclusion:

The SaveIN project demonstrates the power of technology in transforming traditional financial services into a secure, efficient, and user-friendly digital experience. By focusing on key features like secure social financing, automated debt collection, and a comprehensive loan repayment framework, SaveIN successfully addressed the needs of both borrowers and lenders. The platform’s robust security measures, scalable infrastructure, and user-centric design set a new standard in the fintech space, offering a seamless and secure experience for all users. This case study serves as a reference for other fintech companies looking to innovate in the areas of social financing and loan management.

Related content

Auriga: Leveling Up for Enterprise Growth!

Auriga’s journey began in 2010 crafting products for India’s [...]

Stay Close to What We’re Building

Get insights on product engineering, AI, and real-world technology decisions shaping modern businesses.