- Digital Products & Software

Vehicle Insurance Platform to Boost Revenue for a Leading Bank

Vehicle Insurance Platform to Boost Revenue for a Leading Bank

Overview

Imagine this: You’ve taken a vehicle loan from Yes Bank. Now, you’re grappling with the hefty insurance premium. But what if you could take a loan against that very premium? Sounds too good to be true, right? But that’s exactly what Yes Bank wanted to achieve with an insurance platform.

Yes Bank has joined hands with Auriga IT to create a state-of-the-art insurance platform. This platform empowers agents to present customers with the best loan offers quotes against their insurance premiums.

Challenges

Yes Bank aimed to improve their revenue stream and ease the financial burden on commercial vehicle owners by providing them with loan facilities to cover their insurance premiums. But this vision was not without obstacles, they faced challenges such as:

- Identifying Eligible Customers- Yes Bank needed a system that could filter and verify the customers who had taken commercial vehicle loans from them and were eligible for loan against their insurance premium.

- Improving Revenue- Yes Bank entered the lucrative market of commercial vehicle insurance. But they didn’t want to deal with the hassle of providing the insurance themselves. Instead, they wanted to build a smart portal that could scan the offers from different insurance companies and earn commission over that.

- Agent Portal- Yes Bank had a vision of a system that could organize all the customers on one platform, where their agents could fill in the policy and vehicle data for each customer. The system would also automatically send loan offers to the customers who could get loans on the insurance premiums.

Solutions

YES Bank joined hands with Auriga IT to create a web portal YBL – Insurance that could tackle all the challenges mentioned above and offer a comprehensive solution that could address the following needs:

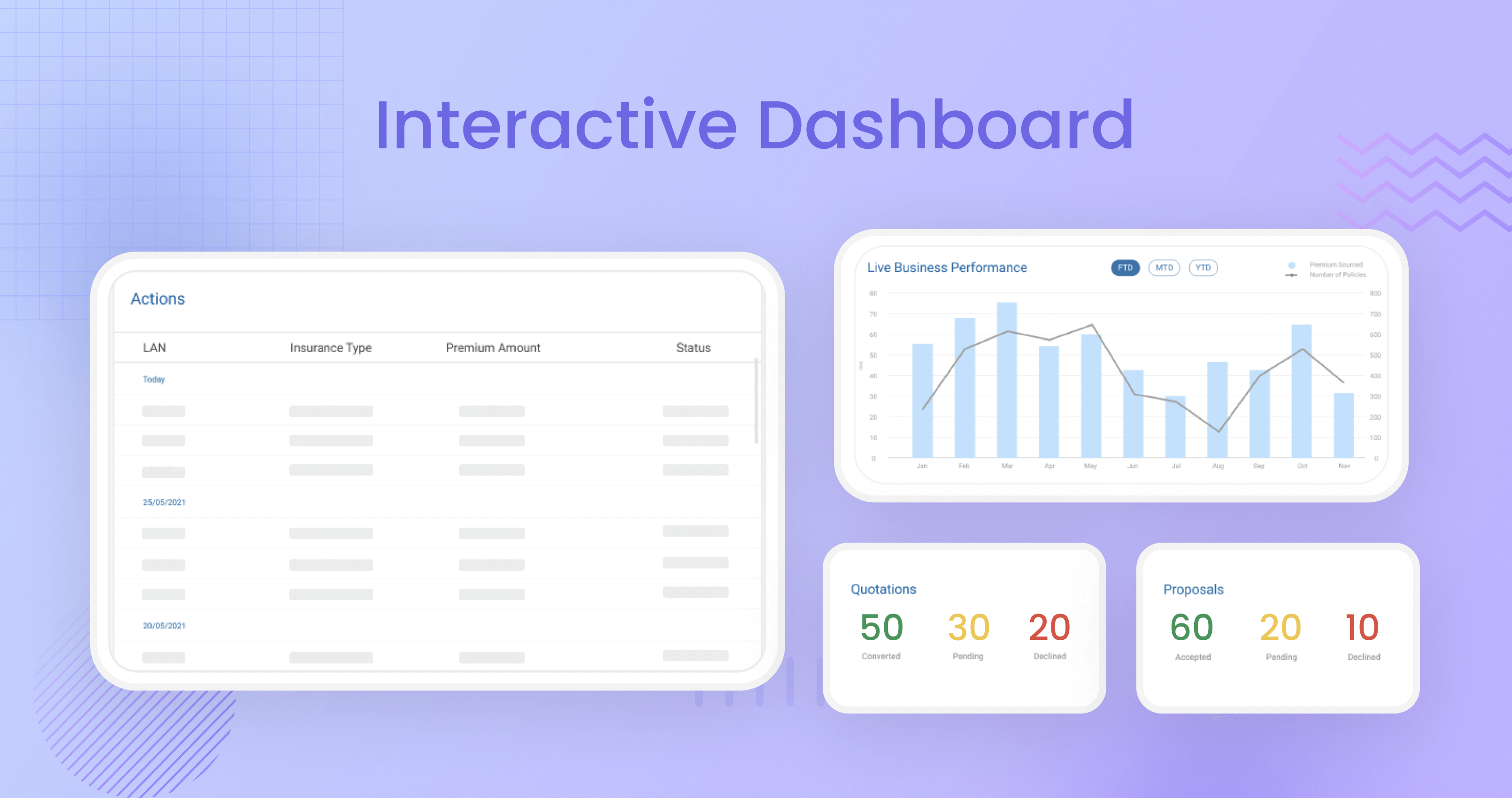

- Interactive Dashboard– An interactive dashboard has been developed by us, where agents can track previous loan offers, leads, and consent given by their qualifying customers. It serves as a compass, with guidance on the next actions for agents being provided. It also provides real-time insights into their progress.

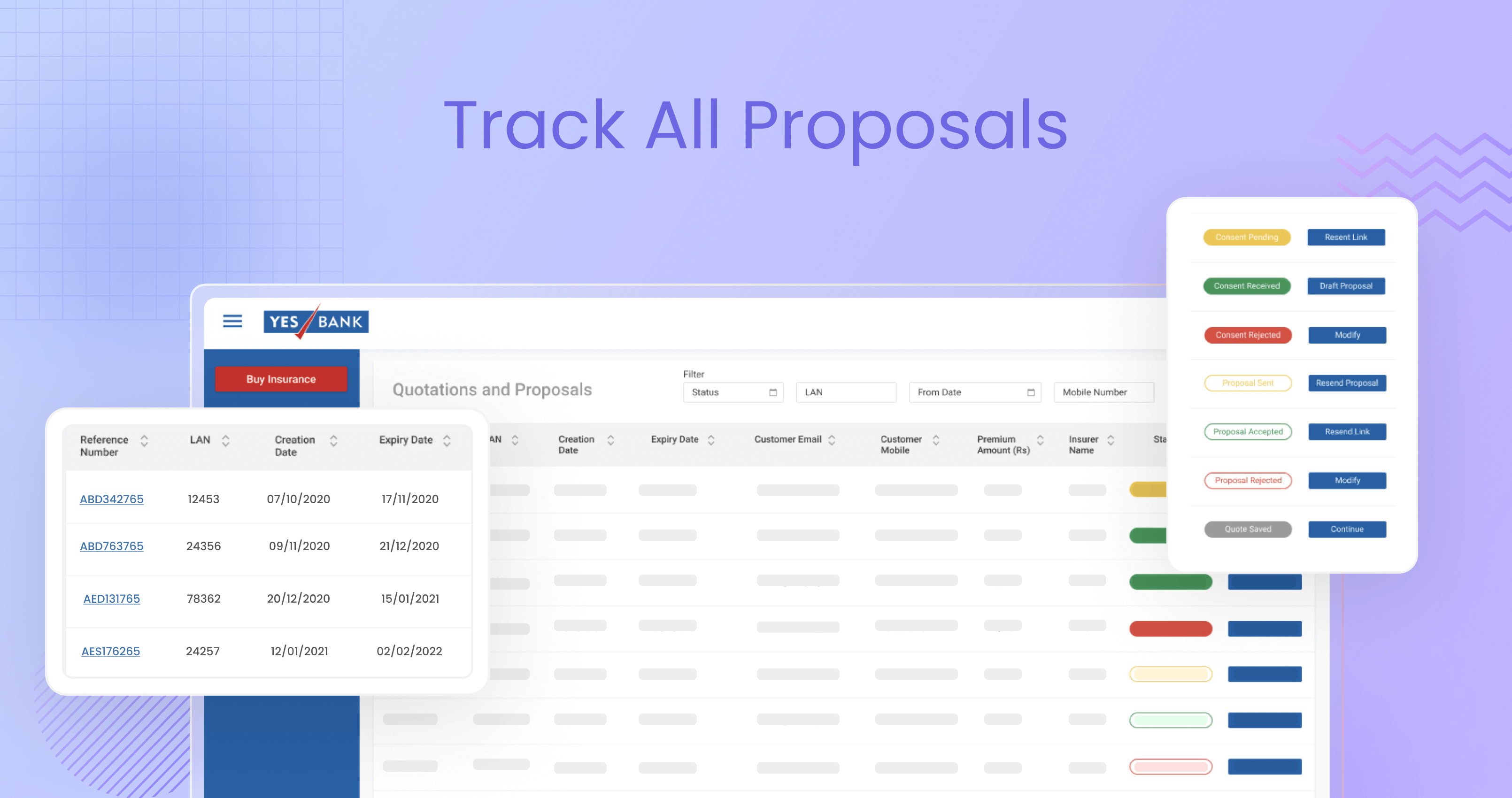

- Track All Proposals- A portal was created by us, where agents can effortlessly navigate and download the status of all proposals. Real-time updates on payment statuses are offered, and an advanced filtering system is featured. This allows searches to be streamlined by agents using filters such as Loan Account Number (LAN), customer email, and mobile number.

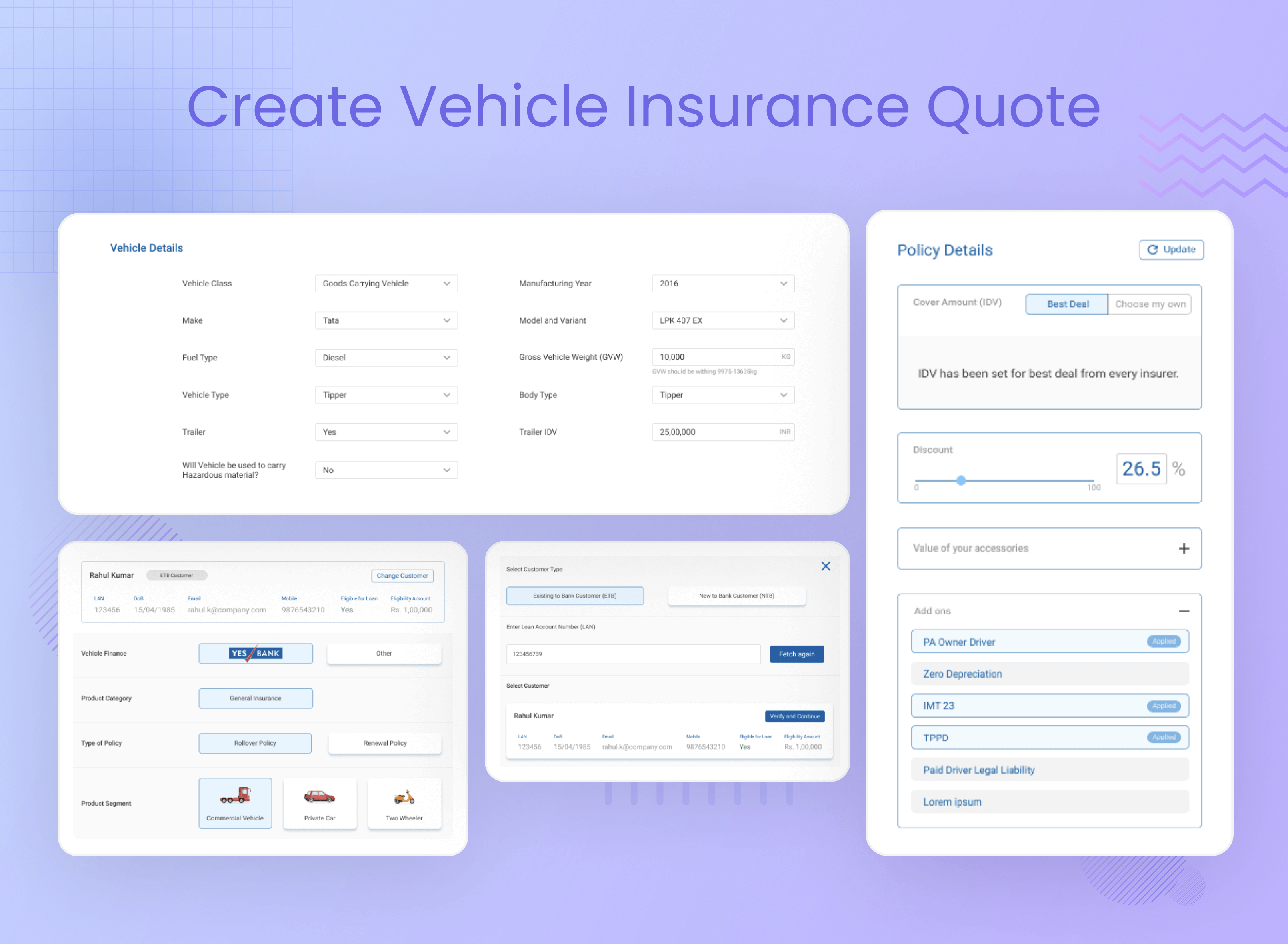

- Create Vehicle Insurance Quote – The Loan Account Number and Customer ID can be filled in by agents, and Vehicle Finance, Product Category, Policy Type, and Product Segment can be selected. A vehicle insurance quote will then be generated by our specially designed system, and all the available offers will be displayed that can be sent by agents to their customers.

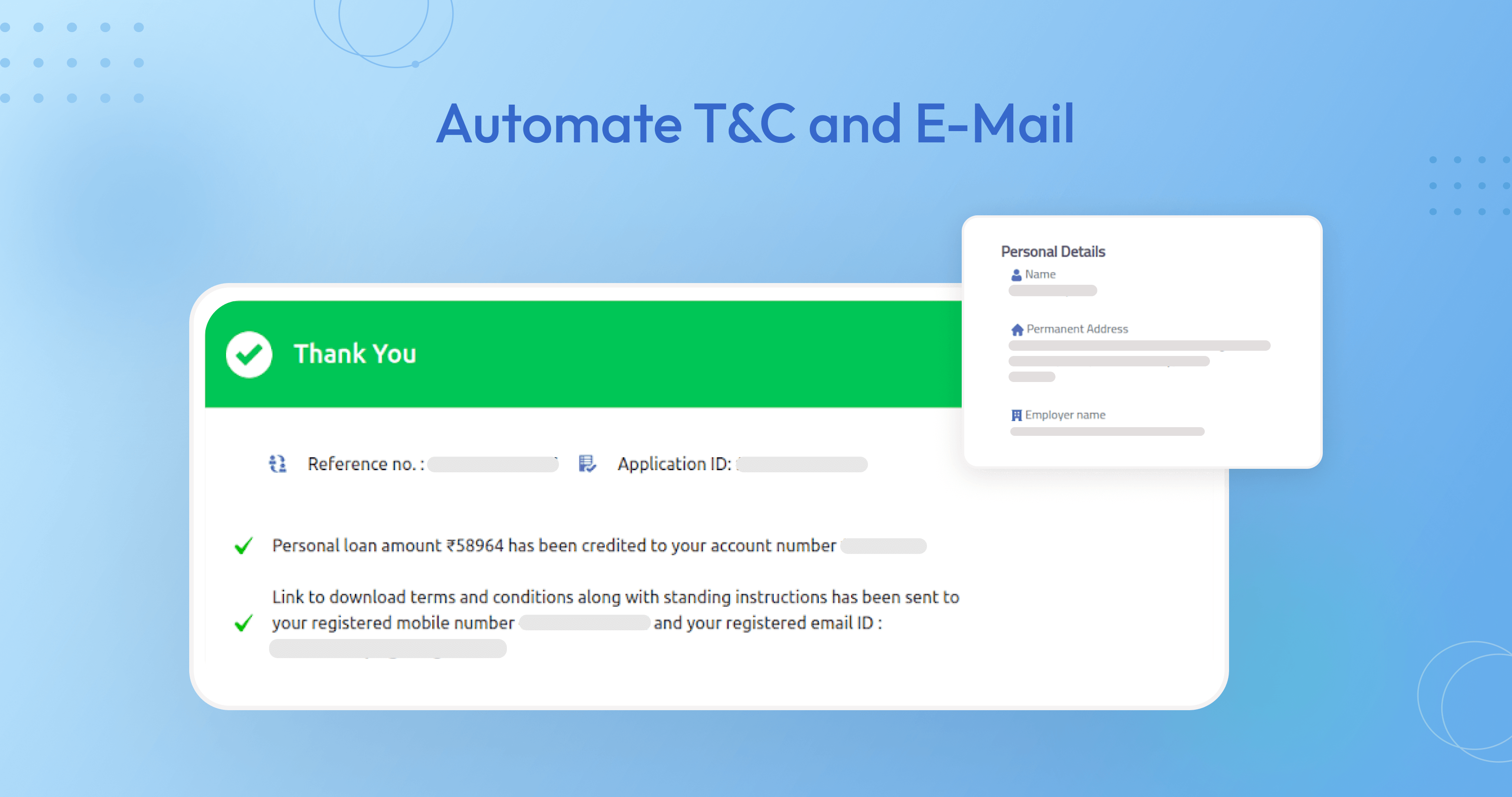

- Automate T&C and E-Mail – After finalizing everything, our solution sends an automated email with all Terms and Conditions and details of the approved loan. This is a dynamic email that is generated based on the amount and other criteria of the borrower.

Project Outcomes

- Enhanced Revenue & Assisted Vehicle Owners- Our platform not only boosts Yes Bank’s revenue but also eases the financial pressure on commercial vehicle owners.

- Generate Insurance Quote- Agents input details, select options, and the system generates insurance quotes that they can send to customers.

Related content

Auriga: Leveling Up for Enterprise Growth!

Auriga’s journey began in 2010 crafting products for India’s [...]

Stay Close to What We’re Building

Get insights on product engineering, AI, and real-world technology decisions shaping modern businesses.